Bulletin Search

Broker Misconduct

The Commission was dismayed by the violence that erupted at the United States Capitol building on January 6, 2021 and has received inquiries about the consequences of broker involvement.

While the Real Estate License Law and Commission rules are primarily focused on broker conduct connected to a real estate transaction, there are provisions in the law that address other conduct. The License Law provides that the Commission can discipline a broker who is found to be unworthy or incompetent to act as a real estate broker in a manner as to endanger the public interest. Likewise, disciplinary action can be taken against a broker who is convicted of certain crimes, including offenses showing professional unfitness. The Commission also considers character and criminal history when determining whether to license an applicant as a broker.

If you believe there has been a possible violation of the Real Estate License Law or Commission rules, please file a complaint with the Commission. If you are a broker and have been convicted of a criminal offense, you are required by law to report it on the Criminal Conviction Reporting form.

The Commission assesses each complaint and reported conviction on a case by case basis.

Regulatory Affairs Case Study: Verify Before You List

– By Fred Moreno, Chief Deputy Legal Counsel

The buyer of residential property filed a complaint against the listing agent, who was also the owner of the subject property.

The listing agent purchased the property through his LLC with thoughts of renovating it and reselling it later. Rather than renovating the property as he typically does, the listing agent decided to market the property “as is” and listed it for sale through his brokerage firm. The property was advertised as being connected to city water and sewer and the square footage was listed as the exact amount noted in tax records with the disclaimer “Sqft is from tax records”. The Listing agent did not measure the subject property to determine the actual square footage and assumed that the subject property was connected to city sewer because it was located in the center of the city and was connected to city water.

A buyer purchased the property from the listing agent, and began renovations. After adding a bathroom, his team attempted to connect that part of the home to the existing sewer line. However, after a week of digging all around the house, they discovered that the property was served by a septic system. In order to connect to the city sewer line, the buyer had to pay a connection fee of over $7k and wait one year for the city to run an extension line from the house to the street for an additional cost also of over $7k.

During the investigation, the firm and broker-in-charge were added as respondents due to the misrepresentation of the material fact regarding the septic system and the reliance upon tax records for the advertised square footage. The buyer agent was also added as a respondent for her failure to discover these issues during her representation of the buyer.

The Commission closed the case against the buyer agent and warned her that the statement on the listing of “Sqft is from tax records” should have been a red flag that the property was not measured. Therefore, the buyer agent should have counseled her client and suggested that he have the property measured. During the investigation, the listing agent, firm, and broker-in-charge have since come to a financial agreement with the buyer to address the issues. The Commission required the listing agent and broker-in-charge to also complete further education prior to closing the case against them. For further information, review the Commission’s “Residential Square Footage Guidelines” brochure. Moreover, it would be good practice to review a copy of the water and sewer utility bill prior to listing a property for sale to ensure your advertising is correct.

Disciplinary Actions

ERICA BARBARA ANDERSON (HOLLY SPRINGS) – By Consent, the Commission reprimanded Ms. Anderson effective February 1, 2021. The Commission found that as qualifying broker/broker-in-charge, Ms. Anderson’s firm falsely advertised the square footage of a home in the MLS when the affiliated listing agent included a basement area with no heat source in the living area, contrary to the professional measurer’s description. Ms. Anderson, as broker-in-charge, was responsible for all advertising for her firm.

KASSIEM SALFAR CARTER (CARY) – By Consent, the Commission suspended the broker license of Mr. Carter for a period of 3 years effective July 1, 2020. The Commission then stayed the suspension effective December 8, 2020.The Commission found that as the qualifying broker/broker-in-charge, the listing agent, and owner-seller of a property, Mr. Carter failed to disclose known material facts. The condo went under contract and was terminated four times before closing and Mr. Carter collected $4,000 in due diligence fees. A home inspection for one buyer revealed that there was no new carpeting, no wood flooring, no new air conditioning unit or ductwork, no new doubled paned windows, and no new sliding glass door as advertised by Mr. Carter. He also falsely advertised that the property qualified for the conventional financing when he knew that there were too many rental properties in the community for buyers to obtain conventional loans. Mr. Carter failed to provide measurement information for his square footage determination which matched tax records and only updated the MLS after Buyer #4 terminated their contract. The Commission noted that Mr. Carter refunded the due diligence and inspection fees to the first four buyers.

KARUNAKER REDDY DONURU (CONCORD) – By Consent, the Commission suspended the broker license of Mr. Donuru for a period of 18 months effective December 8, 2020. The Commission then stayed the suspension in its entirety and placed Mr. Donuru on probation until June 8, 2022. The Commission found that Mr. Donuru, acting as a dual agent, listed his personal residential real property for sale and failed to provide the signed disclosure form to the buyer until after the due diligence period expired.

BILLY W EZZELL (WILMINGTON) – By Consent, the Commission suspended the broker license of Mr.Ezzell for a period of 1 month effective December 1, 2020. The Commission found that, Mr. Ezzell timely self-reported that he pled guilty in December 2018 to five misdemeanor counts of attempting uttering of a forged instrument in connection with insurance business. Mr. Ezzell wrote insurance policies for five friends for the purpose of meeting sales quotas. Mr. Ezzell was sentenced to 45 days in jail, but his sentence was suspended and he was placed on three years of unsupervised probation. Mr. Ezzell was ordered to pay $5,466.49 in restitution to the insurance company, $352.50 in court costs, and to surrender his insurance license for three years. The friends were aware that Mr. Ezzell had written the insurance policies and paid premiums out of his own funds.

TARA LYNN GLENN (HOLLY SPRINGS) – By Consent, the Commission suspended the broker license of Ms. Glenn for a period of 1 month effective February 1, 2021. The Commission then stayed the suspension in its entirety and placed Ms. Glenn on probation until March 1, 2021. The Commission found that Ms. Glenn, acting as a listing agent, hired a vendor to calculate the square footage of the subject property. The vendor indicated that there was a total of 3,419 square feet of heated living area and 1,294 square feet of “partially finished area (below grade)” which was unheated. Ms. Glenn included the unheated area as “Living Area Below Grade” in the MLS representing a total of 4,713 square feet of heating living area instead of 3,419 square feet. In June, 2020, a buyer entered into a backup contract to purchase the subject property after the first contract terminated due to repair issues. The buyer discovered through a home inspection that the basement had no permanent heat source and terminated his contract due to the misrepresentation. After the termination, Ms. Glenn revised the MLS square footage information, and disclosed the repair issues, and the lack of a permanent heat source in the basement to Buyer #3.

TIMOTHY J GOODWIN (BRYSON CITY) – By Consent, the Commission permanently revoked the broker license of Mr. Goodwin effective July 15, 2020. The Commission found that as the qualifying broker and broker-in-charge, Mr. Goodwin’s firm has operated with shortages in its trust accounts since 2015. The management agreements failed to include a broker license number and, in some cases, failed to state the fair housing language in a clear and conspicuous manner. A review of the firm’s trust accounts revealed comingled funds, payments to unlicensed entities for brokerage services, failure to perform monthly reconciliations, funds not being deposited within three business days, and conversion of entrusted funds for personal/business use. In an attempt to cure shortages, Mr. Goodwin made deposits into the firm’s trust accounts in excess of $300,000. This money was obtained through loans in which the monthly payments were being deducted from entrusted funds. Furthermore, the trust account was used as collateral for the loan. The case was a result of a spot audit by Commission staff and did not arise from a consumer complaint.

ELLIS GREG HUNTER (CHARLOTTE) – By Consent, the Commission reprimanded Mr. Hunter effective November 11, 2020. The Commission found that in December 2018, Mr. Hunter voluntarily surrendered his bail bondsman license to the Department of Insurance. Following an investigation, the Department of Insurance found evidence that Mr. Hunter did not properly maintain records and deposit sufficient funds to cover liabilities. Mr. Hunter failed to timely report the voluntary surrender to the Commission.

TAMARA LEA JOHNSON (GREENSBORO) – By Consent, the Commission reprimanded Ms. Johnson effective December 20, 2020. The Commission found that as qualifying broker/broker-in-charge, in January 2020, Ms. Johnson listed a property and inserted language into the Agent Only Remarks of MLS that, “new windows due to broken seals have been ordered for 1st floor office/bedroom, 2nd floor bath and laundry, bedroom, and master.” In February, 2020, a buyer went under contract for the subject property with the understanding that 14 windows in the named rooms would be replaced. The Offer to Purchase and Contract did not reference the windows. In April, 2020, the buyer closed based upon Ms. Johnson’s representation that the windows would be replaced two days after closing. The vendor replaced window panes in certain windows at the subject property and told the buyer that he was not hired to replace entire windows. The buyer obtained an estimate of $7,400 to replace all of the windows in those rooms. Ms. Johnson and the buyer have settled with a payment of $5,531.66 to replace the windows noted on the buyer’s inspection report.

BRUCE WESTLY JUSTICE (FAYETTEVILLE) – By Consent, the Commission suspended the broker license of Mr. Justice for a period of 12 months effective September 15, 2020. The Commission then stayed the suspension effective December 8, 2020, and placed Mr. Justice on probation until September 14, 2021. The Commission found that, while acting as the broker-in-charge, a review of the firm’s trust accounts found: checks, deposit slips, and ledgers failed to contain identifying information as required by Commission rules; trust account reconciliations were not being performed; lack of trial balances; and that not all bank activity was being posted on the ledgers. Furthermore, an owner was holding two Tenant Security Deposits, when the management agreement required the firm to hold these funds. Finally, the firm’s management agreement with one owner stated that it was managing one property when, in fact, it was managing three separate properties on the owner’s behalf.

CRAWFORD JAMES LINEBERGER III (CHARLOTTE) – By Consent, the Commission reprimanded Mr. Lineberger effective January 1, 2021. The Commission found that in 2017, Mr. Lineberger was a member manager-owner of a property listed by another broker. Following an inspection for the buyers, he indicated to the buyer’s broker he disagreed with many of the inspector’s findings. After the completion of the transaction, Mr. Lineberger posted false and defamatory reviews of the inspector on various websites based upon information that Mr. Lineberger did not confirm prior to posting the reviews.

TAMMY KAYE SANDERS (WILMINGTON) – By Consent, the Commission reprimanded Ms. Sanders effective February 1, 2021. The Commission found that as qualifying broker/broker-in-charge, in June 2020, Ms. Sanders posted comments about protests on a neighborhood social media site and a neighbor filed a complaint anonymously with the Commission. Ms. Sanders obtained information about the complaining witness and her family and called the witness’ husband to demand an apology and a retraction of the complaint or she would take legal action. Ms. Sanders further stated that, as a broker, it took her five minutes to find out their personal information, that she could post the witness’ information on social media, and that they should consider themselves lucky they had gone after her instead of others that might wish them harm.

CYNTHIA S STANLEY (NORTH MYRTLE BEACH) – By Consent, the Commission reprimanded Ms. Stanley effective January 1, 2021. The Commission found that as qualifying broker/broker-in-charge, in July 2020, Ms. Stanley made an appointment to show a property which included in the MLS that “Sellers require everyone entering home to wear mask and gloves” due to COVID19. The seller also posted a sign on her front door stating, “no mask, no gloves, no entry. Premises under video surveillance.” In July 2020, an inactive broker employed by Ms. Stanley entered the house with two potential buyers. None were wearing gloves, all were wearing masks, but the inactive broker removed her mask as soon as she entered the house. Ms. Stanley was never present at the showing but after being notified by the listing agent, offered to have the house professionally cleaned although this could not occur until four days after the showing.

CASEY BROOKE STYERS (RALEIGH) – By Consent, the Commission reprimanded Ms. Styers effective December 8, 2020. The Commission found that the Exclusive Right to Sell Listing Agreement, Offer to Purchase and Contract, and Working with Real Estate Agents brochure were executed in the name of Ms. Styers’ unlicensed company and the Listing Agreement failed to include a termination date. The purchase contract called for a 90 day due diligence period with no fee and an Additional Earnest Money Deposit (“AEMD”) of $20,000 with no date listed to be paid. The buyers in the subject transaction represented to Ms. Styers that the AEMD was deposited with an escrow agent, prior to the end of the due diligence period. However, she was unable to confirm that this happened. After the due diligence period expired it was discovered that AEMD was never given to an escrow agent. The subject property did not close and Styers’ seller client never received the AEMD from the buyers. The Commission noted that Ms. Styers has applied for a firm license for her company.

LINDA HILL VAUGHN (GREENSBORO) – By Consent, the Commission suspended the broker license of Ms. Vaughn for a period of 36 months effective December 31, 2019. The Commission found that Ms. Vaughn acted as a dual agent in a residential short sale transaction. Before the lender gave final approval to her buyer client for the purchase of the home, Ms. Vaughn gave her buyer client the keys to allow the buyer client to make repairs to the roof. Ms. Vaughn failed to notify her seller client of this and failed to supervise any work being performed. Ms. Vaughn’s seller client later terminated both the listing agreement and the purchase contract and asked for the keys to be returned. The seller client later discovered that the home was damaged inside which included the floor being torn out, one bathroom gutted, and countertops missing.

WATERSHED LUXURY CABIN MANAGEMENT LLC (BRYSON CITY) – By Consent, the Commission revoked the firm license of Watershed Luxury Cabin Management LLC effective July 15, 2020. The Commission found that the firm has operated with shortages in its trust accounts since 2015. The firm’s management agreements failed to include a broker license number and, in some cases, failed to state the fair housing language in a clear and conspicuous manner. A review of the firm’s trust accounts revealed commingled funds, payments to unlicensed entities for brokerage services, failure to perform monthly reconciliations, funds not being deposited within three business days, and conversion of entrusted funds for personal/business use. In an attempt to cure shortages, the broker-in-charge made deposits into the firm’s trust accounts in excess of $300,000. This money was obtained through loans in which the monthly payments were being deducted from entrusted funds. Furthermore, the trust account was used as collateral for the loan. The case was a result of a spot audit by Commission staff and did not arise from a consumer complaint.

NCDHHS Launches “Find My Vaccine Group” to Help North Carolinians Know When They Have a Spot to Take Their Shot

The North Carolina Department of Health and Human Services launched a new online tool to help North Carolinians know when they will be eligible to get their vaccine. Find My Vaccine Group walks users through a series of questions to determine which vaccine group they are in. People can then sign up to be notified when their group can get vaccinated.

“Given the very limited supplies we currently have, there may be wait times, but every North Carolinian has a spot. A spot for accurate information. A spot in line. A spot to take their shot,” said NCDHHS Secretary Mandy K. Cohen, M.D.

North Carolina’s goal is to vaccinate as many people as quickly and equitably as possible. Local vaccine providers have worked tirelessly to ramp up and vaccinate people under difficult circumstances. This past week, in response to indications that the federal government might base future allocations on the supply states have on hand, the state and providers worked to rapidly administer vaccinations and exhaust North Carolina’s current supply of first doses.

As of Sunday evening, 88% of all first doses have been reported as being administered. Providers reported administering more than 260,000 doses this past week. As of this morning, the Centers for Disease Control and Prevention ranked North Carolina 10th in total vaccines administered and 29th in vaccines administered per 100,000 people. These numbers were achieved by three actions the state took, including facilitating large-scale vaccination events, asking providers to aggressively ramp up their vaccine throughput this past week with any needed support from the state and working with many providers to stand up special events reaching underserved communities.

Beginning on Jan. 27, North Carolina will have only 120,000 doses to allocate across the entire state. A large portion of those doses are committed to the large-scale events planned several weeks ago to address the backlog in vaccine. As a result, many providers are getting small or no allocations for the coming week. Through no fault of their own, they will be postponing appointments.

“As long as we are getting such a small amount of vaccine as a state, there are going to be challenges and shortages as we try to ensure equitable access to vaccine, while getting shots into arms quickly. We understand this is hard for providers who are doing everything right,” Secretary Cohen said.

NCDHHS will be sharing more detailed guidance on the process for allocations for the coming weeks to ensure more transparency and certainty now that the state has largely exhausted the backlog of vaccine supply. Because vaccine supply is limited, states must vaccinate people in groups. To save lives and slow the spread of COVID-19, independent state and federal public health advisory committees recommend first protecting health care workers, people who are at the highest risk of being hospitalized or dying and those at high risk of exposure to COVID-19.

North Carolina is currently vaccinating people in Groups 1 and 2, which include health care workers, long-term care staff and residents and people 65 and older. Group 3 will include frontline essential workers; Group 4 will include adults at high risk for exposure and increased risk of severe illness; and Group 5 will include everyone. Detailed information about each group is online at YourShotYourSpot.nc.gov (English) or covid19.ncdhhs.gov/vacuna (Spanish).

Future updates will include a vaccine finder and other interactive features so that every North Carolinian has a spot for information and is able to take their shot.

Until the country begins to get ahead of the pandemic, the CDC says everyone should keep wearing a mask, waiting at least six feet apart and washing hands often. North Carolina continues to have high rates of cases, hospitalizations and the percent of tests that are positive. A secretarial directive remains in effect. People should stay home and only leave for essential purposes such as buying food, accessing health care and going to school or work.

For more information and to find your vaccine group, visit findmygroup.nc.gov.

This information is from – https://www.ncdhhs.gov/news/press-releases/ncdhhs-launches-%e2%80%9cfind-my-vaccine-group%e2%80%9d-help-north-carolinians-know-when-they

When is the deadline for Continuing Education?

Are you confused about the continuing education (CE) deadline for this license year? Do you know which CE courses you need to take? Did you know you can search for available CE courses on the Commission’s website?

CE Requirement

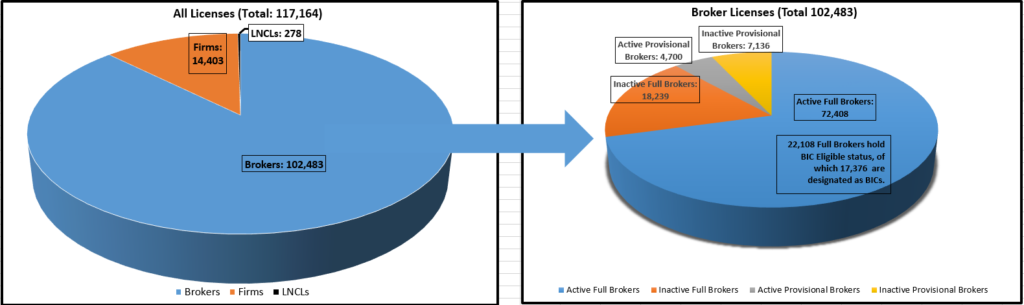

Rule 58A .1702 dictates that, to maintain an active license, a broker must take eight (8) hours of CE each year.

- Provisional Brokers and non-BIC Brokers must take the General Update course and one Commission-approved elective.

- BICs and BIC-Eligible Brokers should* take the BICUP (Broker-in-Charge Update) course and one Commission-approved elective.

*A BIC or BIC-eligible Broker who takes the General Update course and an elective will maintain an Active license but will lose his/her BIC Eligible status and BIC designation.

Not sure which Update course you need to take? Login to your license record on the Commission’s website to check your license status before registering for a course.

CE Deadline

In 2020, the Commission extended the deadline for brokers to complete their continuing education requirements for license year 2019-2020, due to COVID-19.

This year, however, brokers must complete CE by the standard deadline, June 10. Specifically, brokers must complete all 8 hours of CE for the 2020-21 license year by June 10, 2021.

Not sure which courses you need to take? Login to your license record on the Commission’s website to check your CE record.

CE Course Search

CE Update and elective courses are offered in variety of formats. Update courses are offered in person and via synchronous distance learning (aka, “live online” instruction using Zoom or similar technologies). Elective courses are also offered via distance courses (self-paced online courses).

To search for in-person and “live-online” CE Update and elective courses:

- go to www.ncrec.gov;

- click on the Education menu;

- click on Search CE Course Schedules; and

- click on Search Providers.

- A full listing of courses currently scheduled across the state will be displayed. Note that you may enter search criteria, such as provider, instructor, or city, to shorten the list.

- Contact an Education Provider directly to register for a course.

To search for providers that offer self-paced, online CE elective courses:

- go to www.ncrec.gov;

- click on the Education menu; and

- click on List of Distance CE Providers.

- A full listing of providers will be displayed.

- Contact an Education Provider directly to register for a course.

For more information, contact the Education and Licensing Division at LS@ncrec.gov or 919.875.3700.