Bulletin Search

Disciplinary Actions

CHRISTOPHER ALLEN BRADSHAW (CHARLOTTE) – By Consent, the Commission permanently revoked the license of Mr. Bradshaw effective April 1, 2022. The Commission found that Mr. Bradshaw, was qualifying broker/broker-in-charge of a licensed firm and was also a general contractor and owner of a construction company. Mr. Bradshaw acted as listing agent to market properties built by his construction company. Mr. Bradshaw failed to disclose liens, judgments, and/or foreclosures that would prevent Mr. Bradshaw from closing on multiple properties. Mr. Bradshaw accepted multiple deposits which were required to be held by Seller while knowing that the properties could not close timely and then used those deposits to refund other deposits on failed transactions.

ERIC TROY BYRD (APEX) – The Commission accepted the voluntary surrender of the broker license of Mr. Byrd effective August 17, 2022. The Commission dismissed without prejudice allegations that Mr. Byrd violated provisions of the Real Estate License Law and Commission rules. Mr. Byrd neither admitted nor denied misconduct.

CITY VIEW TERRACES LLC (CHARLOTTE) – By Consent, the Commission permanently revoked the firm license of City View Terraces LLC effective April 1, 2022. The Commission found that City View Terraces acted as listing agent to market properties built by the construction company owned by the firm’s qualifying broker/broker-in-charge. City View Terraces LLC failed to disclose liens, judgments, and/or foreclosures that would prevent the firm’s qualifying broker/broker-in-charge from closing on multiple properties. The firm’s qualifying broker/broker-in-charge accepted multiple deposits which were required to be held by Seller while knowing that the properties could not close timely and then used those deposits to refund other deposits on failed transactions.

ALEXANDRA DOBRIN (CHARLOTTE) – By Consent, the Commission suspended the broker license of Ms. Dobrin for a period of 2 years, effective June 20, 2022. The Commission then stayed the suspension in its entirety. The Commission found that in June 2019, Ms. Dobrin acted as listing agent for the sale of property served by a septic system. Ms. Dobrin failed to obtain and review the septic permit and misrepresented the subject property as having four bedrooms when the septic permit specified three bedrooms. In 2020, Ms. Dobrin relisted the property for the buyer in the 2019 transaction and again failed to review the septic permit leading to the same misrepresentation. The property was subsequently listed by a new listing agent and the property was sold with the new buyer aware of the actual septic permit allowance. Ms. Dobrin has reached a settlement with the 2019 buyer to the buyer’s satisfaction.

LAURA JOY GUY (RALEIGH) – By Consent, the Commission suspended the broker license of Ms. Guy for a period of 3 months, effective May 1, 2022. The Commission found that in September 2021, Ms. Guy was enrolled in HPW Real Estate School in Postlicensing Course 303 – NCLAW. Ms. Guy was required to successfully complete an end-of-course exam to receive credit for the course. The exam was administered to Ms. Guy remotely, utilizing a proctor to facilitate and monitor the exam process. The proctor observed Ms. Guy had open notes during the exam and copied and pasted an exam question into a Word document on her computer. Screen shots were taken showing this activity.

OSAMA MILAD ESKANDER NICOLA (CHARLOTTE) – By Consent, the Commission suspended the broker license of Mr. Nicola for a period of 3 months, effective June 1, 2022. The Commission found that in January 2021, Mr. Nicola listed residential property he had purchased in September 2020 and failed to disclose that the extensive renovation work he supervised, had not been permitted or inspected. After the first buyer terminated following inspections, Mr. Nicola re-listed the property, used the original RPOADS on which he had answered no representation to all questions, and failed to disclose material facts learned from the first buyer’s home inspection. The Commission noted the Mr. Nicola has refunded the buyer the due diligence fee and other costs.

NOY PROPERTIES LLC (GARNER) – The Commission accepted the voluntary surrender of the firm license of Noy Properties LLC effective August 17, 2022. The Commission dismissed without prejudice allegations that Noy Properties violated provisions of the Real Estate License Law and Commission rules. Noy Properties neither admitted nor denied misconduct.

CORY STEPHEN RUSHATZ (SANFORD) – By Consent, the Commission suspended the broker license of Mr. Rushatz for a period of 30 days, effective July 1, 2022. The Commission found that in and around 2020, Mr. Rushatz, acting as listing broker, misrepresented the square footage of several properties by relying on county tax records to represent the square footage. Around January 2021, a member of Mr. Rushatz’s firm offered to buy property from a client to facilitate the sale of adjacent property of the client, and purchased the property. Mr. Rushatz, acting as listing broker for both tracts, failed to deliver a written disclosure of the potential conflict of interest to his seller-client. Mr. Rushatz also failed to terminate the listing agreement or refer the seller-client to another real estate brokerage firm prior to the transaction. The client was aware the purchaser was associated with the firm.

JACQUELINE DENISE YON (GARNER) – The Commission accepted the voluntary surrender of the broker license of Ms. Yon effective August 17, 2022. The Commission dismissed without prejudice allegations that Ms. Yon violated provisions of the Real Estate License Law and Commission rules. Ms. Yon neither admitted nor denied misconduct.

Remote Electronic Notarization is Here to Stay

On July 8th, Governor Cooper signed House Bill 776 into law, authorizing Remote Electronic Notarization (aka Remote Online Notarization or “RON”) once again in North Carolina.

In 2020, temporary legislation was enacted to allow for Emergency Video Notarization after the COVID-19 pandemic necessitated social distancing. However, that legislation expired last year.

With the signing of House Bill 776 into law, the ability to use Emergency Video Notarization is restored until 6/30/2023. The Emergency Video Notarization law allows a regular notary to perform acknowledgments and oaths/affirmations for a person located in North Carolina using live/real-time video conference technology to verify the person’s identity.

In July 2023, a new Remote Electronic Notarization program will be implemented. The new statute defines Remote Electronic Notarization in North Carolina moving forward, creating a new category of notary, the remote electronic notary. These notaries can perform notarial acts without the requirement to be in the physical presence of the signer. They are required to use remote communication technology platforms that are secure, capable of recording and geolocation, and licensed by the NC Secretary of State. The Secretary of State has been tasked with creating rules to implement the program and technology platform for an effective date of July 1, 2023.

The restoration of Emergency Video Notarization and the new Remote Electronic Notarization program may affect the way some law offices handle closings. Please check with your closing attorney if you have any questions about how this law might change the real estate closing process.

Staff Appearances

Christy Evans, Consumer Protection Officer, spoke at the Union County Association of REALTORS meeting on August 4.

Jean Hobbs, Auditor/Investigator and Brian Heath, Consumer Protection Officer, spoke at the Canopy REALTOR Association meeting on August 12.

Sheryl Graham, Consumer Protection Officer, spoke at the Lake Norman Realty office meeting on August 17.

Employment Opportunities Available

Are you interested in joining the staff of the North Carolina Real Estate Commission? From time to time, employment opportunities become available. They are posted on the Commission’s website under the “About Us” tab.

Click here for more information.

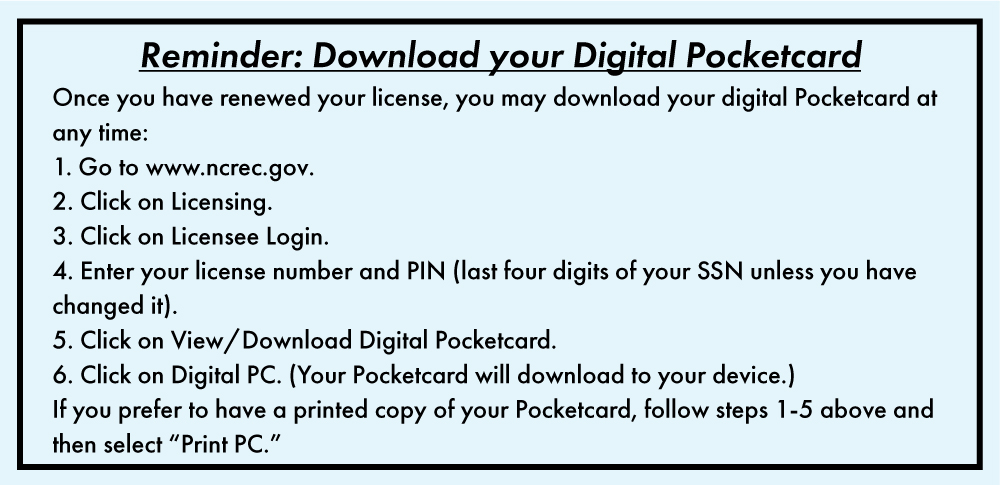

NCREC: Learning Management System

The Commission has established an online training portal to deliver courses required by License Law and Commission rules and provide valuable information to brokers, education providers and instructors. The new platform is separate from the Commissions website and can be found at learn.ncrec.gov.

As a first time user, you will need to register at learn.ncrec.gov. Your login credentials for learn.ncrec.gov are separate from your other login credentials in existence with the Commission.

Courses currently available in the learning management system include the following:

Commission Rule 58A .0110(e) requires that brokers who request BIC-Eligible Status either complete the 12 hour Broker-in-Charge course within one year prior to submitting the Request for BIC-Eligible Status and/or BIC Designation (Form REC 2.25) or complete the course within 120 days after becoming BIC-Eligible.

The 12 Hour Broker-in-Charge course titled, The Great BIC Journey: Learning to Serve the People and Places of North Carolina is available on the Commission’s new platform at learn.ncrec.gov. A link to the course is also available on the Commission’s website under the Education Tab.

The Great BIC Journey is divided into three 4-hour modules. There are interactive exercises involving the rules and statutes, images, narrated slides and practical applications of the information. There is no final exam required; however, students must complete individual assessments throughout the course.

Brokers who successfully complete the 12- Hour Broker-in-Charge course will receive 4 hours of continuing education elective credit.

Commission Rule 58A .0110(g)(9) requires that a designated BIC complete the Commission’s Basic Trust Account Procedures course within 120 days of assuming responsibility for a trust account.

Taking the Right Path for Trust Accounts is the Basic Trust Account Procedures course. The course is divided into 14 separate modules and covers topics such as trust account requirements, trust account responsibilities, depositing and disbursement of funds, record keeping and audits. The course takes students 4 hours to complete and is full of practical applications including the process of account reconciliation. There is no final examination for the course; however, students do complete assessments at the end of each module.

You can find a link to register for the course at learn.ncrec.gov under the Education Tab. Brokers who successfully complete the course will receive 4 hours of continuing education elective credit.

INSTRUCTOR DEVELOPMENT WORKSHOPS

Instructors are required by Rule 58H .0306 to complete 6 hours of an instructor educational development program each year in order to renew their instructor approval. There are several ways that instructors can obtain this credit such as attending the Commission’s Spring Educators Conference or the Real Estate Educators Association conferences and workshops, including the NCREEA Fall Conference.

In order to provide instructors with additional options, the Commission has added two 3-hour instructor development workshops to its online learning portal. These courses do not provide CE credit.

Fundamental Principles on the Road to Better Teaching includes information that helps instructors and education providers comply with the requirements of Rule 58H .0304 regarding instructor conduct and performance. It provides guidance on crafting learning objectives, developing relevancy for the students, using visual imagery and assessing the students.

Teaching is Not a Spectator Sport provides guidance, ideas and practical tips for increasing student engagement. The engagement of students is critical to learning, whether teaching in a live, synchronous, or distance format.

All of the courses are self-paced asynchronous courses and must be completed within 30 days of course registration. Regardless of which courses a broker takes, here are some practical tips that will make their learning adventure more enjoyable in the online learning portal.

- In order to save their progress and return to the course at another time, a broker must log out of the portal in order for their work to be saved.

- These courses contain a lot of content and features. They do not work well on mobile devices such as a cell phones or hand held-devices. We recommend that you take these courses on a computer or laptop.

- Brokers should not switch devices while taking the course. A broker should finish the course on the same type of device they used when they began the course.

The Commission is excited to bring information to brokers and instructors while using a new, convenient platform.

Links to all of the courses referenced in this article are provided under the Education Tab on the Commissions website. For more information, you may contact the Education and Licensing Division at LS@ncrec.gov or 919.875-3700.

Leonard C. “Len” Elder Named Director of Education and Licensing

Leonard C. “Len” Elder has been named Director of Education and Licensing for the Commission, effective June 29, 2022. Elder joined the Commission as Education and Development Officer in 2019.

Elder has a B.A. in both Speech Communication and Political Science & Economics, and a law degree from Capital University Law School. Len is a resident of Cary, North Carolina with his wife, Alexandra.

After several years in the private practice of law and then serving as Vice President of a mortgage company, Elder embarked on a career in adult education, specializing in real estate education. During his career, he has served as the Lead Instructor and Curriculum Developer for schools of real estate, and for several years, had his own course creation company.

Elder brings to the position 25 years of experience directing, planning, implementing and evaluating real estate education. He has developed standards and training for the delivery of real estate educational courses approved by the Commission. He has countless hours of live classroom experience in Prelicensing, Postlicening and Continuing Education. He has also written and taught multiple courses involving real estate and related legal issues.

He holds both the Gold Standard Instructor (GSI) and the Distinguished Real Estate Instructor (DREI) designations from the Real Estate Educators Association. He is also the recipient of the National Real Estate Instructor of the Year from the national Real Estate Educators Association (REEA), the North Carolina Real Estate Instructor of the Year from the North Carolina Real Estate Educators Association, and was recognized as the national course author of the year by REEA.

Elder has served as Past President of the North Carolina Real Estate Educators Association (NCREEA) and is the recipient of the Larry A. Outlaw Excellence in Education Award from the North Carolina Real Estate Commission. Earlier this year, REEA honored Elder with the first ever Dedication to Excellence Award recognizing over a decade of dedication and service to real estate education.

The primary responsibility of the Director of Education and Licensing is to plan and direct the Commission’s education, examination, and licensing programs and operations statewide.

Opening a Real Estate Broker Trust Account

The Law:

G.S. 93A-6(g) states that “a broker’s trust or escrow account shall be a demand deposit account in a federally insured depository institution lawfully doing business in the State which agrees to make its records of the broker’s account available for inspection by the Commission’s representatives”

North Carolina Real Estate Commission Rules:

21 NCAC 58A .0117 (b) states that “a trust or escrow account shall satisfy the requirements of G.S. 93A-6(g) and shall be designated as a “Trust Account” of “Escrow Account”. All bank statements, deposit tickets and checks drawn on said account shall bear the words “Trust Account” or “Escrow Account”. A trust account shall provide for the full withdrawal of funds on demand without prior notice and without penalty or deduction to the funds.

21 NCAC 58A .0117 (4)(c) states “a broker may maintain a maximum of one hundred ($100.00) in company funds in the trust account for the purpose of paying service charges incurred by the account. In the event that the services charges exceed one hundred dollars ($100.00) monthly, the broker may deposit an amount each month sufficient to cover the service charges. A broker shall maintain a separate ledger for company funds held in the trust account identifying the date, amount and running balance for each deposit and disbursement.”

Why do Brokers sometimes have difficulty opening a Real Estate Broker Trust Account at a bank or federally insured depository institution?

Sometimes a broker runs into difficulty opening a trust or escrow account at a bank or federally insured depository institution. Most often the problem is a result of the banker requiring the broker to provide them with a formal trust agreement.

So why the confusion? It is fairly common for individuals and families to create a formal trust agreement for the purpose of distributing assets upon an individual’s death. This may be done to protect property in an estate or to avoid probate. The person who manages a trust on behalf of a beneficiary is a trustee. So, the banker hears you want to open a trust account and then requires that the broker provide a written trust agreement to establish the account.

In real estate brokerage, the broker is a fiduciary to the people whose money is held in the trust or escrow account. Though this fiduciary relationship exists, the broker is not a “trustee” and there is no formal trust document.

When Establishing a Trust or Escrow Account – Give the Following Information to the Banker.

- Ask to open a business checking account (this is a demand deposit account).

- Verify that the account is “federally insured”.

- Have the banker designate the account(s) as a “Trust Account” or Escrow Account” by adding the designation to all bank statements, deposit tickets and all checks drawn on the account.

- Explain that no written trust agreement is required.

The broker may need to tell the Banker that the account is similar to an attorney trust account, in that there is no trust agreement.

If the broker provides the preceding information and the banker still insists on requiring a formal trust agreement, the broker may want to consider using another bank or depository institution. There are probably tens of thousands of real estate trust or escrow accounts in the State of NC, so it should be relatively easy to find a banker to open your real estate broker trust account.

Other Considerations or Recommendations

- The broker can open and maintain the account with a maximum of $100 of broker or company funds for the purpose of paying service charges incurred by the account. However, the broker does not have to have any personal or company funds in the account. If the firm also maintains an operating account (non-trust acct) at the bank, the banker may be able to deduct any service fees incurred from the trust account from the non-trust operating account.

- Many brokers that engage in property management prefer to open several trust or escrow accounts. Often brokers decide to open separate accounts for tenant security deposits and rents. Many brokers have found it beneficial to make the checks different colors, as a way to easily identify the account.

Employment Opportunities Available

Are you interested in joining the staff of the North Carolina Real Estate Commission? From time to time, employment opportunities become available. They are posted on the Commission’s website under the “About Us” tab.

Click here for more information.

Staff Appearances

Dee Bigelow, Information Officer, spoke at the Greenridge Realty meeting on July 19.

Disciplinary Actions

CAROLINA TRACE GATED PROPERTIES LLC (SANFORD) – By Consent, the Commission suspended the broker license of Carolina Trace Gated Properties LLC for a period of 12 months, effective July 1, 2022. The Commission then stayed the suspension in its entirety. The Commission found that the Firm failed to verify the advertising of a broker affiliated with the Firm, resulting in listings advertised with inaccurate square footage figures.

FATHOM REALTY NC LLC (CHARLOTTE) – By Consent, the Commission reprimanded Fathom Realty NC LLC, effective June 20, 2022. The Commission found that the Firm was the listing firm for the sale of a residential property. The individual listing agent failed to verify the property’s septic permit and advertised the property as having four bedrooms when the septic permit specified three bedrooms. The listing agent has entered into a settlement with the 2019 buyer to the buyer’s satisfaction and the buyer has now sold the property.

ALVARO JOEL VILLARROEL GOMEZ (CHARLOTTE) – By Consent, the Commission revoked the broker license of Mr. Gomez effective July 1, 2022. The Commission found that in January 2022, Mr. Gomez submitted an Affidavit for Name Change along with a NC Court Order for the name change. Mr. Gomez has not had a legal name change and knowingly submitted invalid and fraudulent documents to the Commission.

C JON HINES (CHARLOTTE) – Following a hearing, the Commission suspended the broker license of Mr. Hines for thirty-six months effective July 1, 2022, provided however, that the first twelve months shall be active and the remaining twenty-four months shall be stayed. Mr. Hines shall not hold himself out to be a broker-in-charge or become broker-in-charge eligible for a period of five years from July 1, 2022. The Commission also withdrew Mr. Hines’ instructor approval for a period of three years effective July 1, 2022. The Commission found that Mr. Hines, as broker-in-charge of a Housemax LLC, altered pre-approval letters and did not obtain approval from the lender to alter the pre-approval letters. Mr. Hines also failed to provide all firm transactional records as requested by the Commission’s investigator.

HOUSEMAX LLC (CHARLOTTE) – Following a hearing, the Commission permanently revoked the firm license of Housemax LLC effective July 1, 2022. The Commission found that Mr. Hines, as broker-in-charge of the Firm, altered pre-approval letters and did not obtain approval from the lender to alter the pre-approval letters. The Firm also failed to provide all firm transactional records as requested by the Commission’s investigator.

JOSEPH ROBERT KENDRICK (BURGAW) – By Consent, the Commission suspended the broker license of Joseph Robert Kendrick for a period of 12 months, effective July 15, 2022. The Commission then stayed the suspension in its entirety. The Commission found that Mr. Kendrick, acting as the broker-in-charge of a firm, also acted as the listing agent under a limited service agreement. Mr. Kendrick advertised the square footage of the subject property and the bedroom count based on his seller client’s assertions and without independently verifying the information by measuring the property or attempting to pull the septic permit. The seller of the subject property also made renovations to it and Mr. Kendrick failed to verify whether any required permits were pulled prior to listing. A buyer went under contract to purchase the subject property and discovered, during their due diligence, that a septic permit could not be found and that permits were not pulled during the renovation. The buyer then terminated the contract. The subject property went under contract two more times prior to Mr. Kendrick updating the MLS advertisement to reflect the septic and permit issues.

WILLIAM R MONCURE (RALEIGH) – By Consent, the Commission suspended the broker license of William R Moncure for a period of 6 months, effective July 1, 2022. The Commission then stayed the suspension in its entirety. The Commission found that Mr. Moncure, acting as a listing agent, advertised a property as a five-bedroom house based on the seller’s representation. Mr. Moncure failed to discover and disclose that the property was permitted for a three-bedroom septic. A buyer under contract to purchase the property discovered the discrepancy and the seller refused to refund the buyer’s $15,000 due diligence fee until the buyer retained counsel. Upon discovering that the permit was only for a three-bedroom septic, Mr. Moncure immediately revised his MLS listing. He also called the Commission to advise on the matter and seek guidance. The subject property has since been sold with the correct MLS listing and disclosures in place. Mr. Moncure has also entered into a civil settlement with the first buyer to the buyer’s satisfaction.

CHARLES C POWELL II (CHARLOTTE) – The Commission accepted the permanent voluntary surrender of the broker license of Mr. Powell effective July 1, 2022. The Commission dismissed without prejudice allegations that Mr. Powell violated provisions of the Real Estate License Law and Commission rules. Mr. Powell neither admitted nor denied misconduct.

ALFRED S RUSHATZ (SANFORD) – By Consent, the Commission suspended the broker license of Alfred S. Rushatz for a period of 12 months, effective July 1, 2022. The Commission then stayed the suspension in its entirety. The Commission found that Mr. Rushatz as qualifying broker and broker-in-charge of a firm, failed to verify the advertising of a broker affiliated with Mr. Rushatz’s firm. This resulted in listings advertised with inaccurate square footage figures. Mr. Rushatz engaged in the practice of law in North Carolina without a law license when he prepared a deed in a real estate transaction.

CHERIE L SCHULZ (RICHLANDS) – The Commission accepted the voluntary surrender of the broker license of Ms. Schulz effective July 20, 2022. The Commission dismissed without prejudice allegations that Ms. Schulz violated provisions of the Real Estate License Law and Commission rules. Ms. Schulz neither admitted nor denied misconduct.

CHERIE SCHULZ REALTY FIRM INC (RICHLANDS) – The Commission accepted the voluntary surrender of the broker license of Cherie Schulz Realty Firm Inc. effective July 20, 2022. The Commission dismissed without prejudice allegations that Cherie Schulz Realty Firm Inc. violated provisions of the Real Estate License Law and Commission rules. Cherie Schulz Realty Firm Inc. neither admitted nor denied misconduct.

USREALTY.COM LLP (BURGAW) – By Consent, the Commission suspended the broker license of USRealty.com LLP for a period of 12 months, effective July 15, 2022. The Commission then stayed the suspension in its entirety. The Commission found that the Firm acted as the listing agent under a limited service agreement. The Firm advertised the square footage of the subject property and the bedroom count based on its seller client’s assertions and without independently verifying the information by measuring the property or attempting to pull the septic permit. The seller of the subject property also made renovations to it and the Firm failed to verify whether any required permits were pulled prior to listing. A buyer went under contract to purchase the subject property and discovered, during their due diligence, that a septic permit could not be found and that permits were not pulled during the renovation. The buyer then terminated the contract. The subject property went under contract two more times prior to the Firm updating the MLS advertisement to reflect the septic and permit issues. The Firm has since created additional training and policies for its agents.