Bulletin Search

Disciplinary Actions

DEBRA AGOSTINELLI (MOORESVILLE) – By Consent, the Commission suspended the broker license of Agostinelli for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Agostinelli represented the buyer in the subject transaction. The subject property was recently remodeled. The sellers did not use licensed tradespeople to perform the remodel, did not obtain permits, and did not use a licensed general contractor. Agostinelli searched for permits and, finding none, inquired about the remodel with sellers’ agent, and was told no permits were required. Agostinelli failed to confirm the cost or extent of the remodel, or whether the remodel was by licensed contractors. Agostinelli also failed to provide and review Working with Real Estate Agents Disclosure at first substantial contact.

ANCHOR REAL ESTATE OF EASTERN NORTH CAROLINA (JACKSONVILLE) – By Consent, the Commission suspended the firm license for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Anchor Real Estate provided property management services to 213 properties and maintained 3 trust accounts: rental, security deposit, and vacation rental. Anchor Real Estate failed to report to the Commission that it maintains trust accounts in either the firm application or subsequent renewals. Anchor Real Estate failed to designate “trust” or “escrow” on checks or deposit slips. In each of two months, there was a shortage or an overage in both the Rental and Security Deposit accounts. The balance on the property ledgers was different from the allotted reserve amounts agreed upon in the property management agreements.

WILLIAM SHANE COLLINS (KITTY HAWK) – By Consent, the Commission suspended the broker license of Collins for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Collins represented the buyers in the subject transaction. Collins failed to disclose to his buyer-clients that the sellers of the subject property owned the vacant, waterfront lot across the street from the subject property. Collins failed to discover and disclose that the sellers intended to build a new home on the vacant lot.

JERRY THOMAS FERRELL JR. (ASHEVILLE) – By Consent, the Commission reprimanded Ferrell effective July 1, 2024. The Commission found that in a vacant land sale transaction where the seller wished to retain a 0.53-acre parcel, Ferrell was broker-in-charge for two dual agents and failed to ensure that the Working with Real Estate Agents Disclosure was properly completed, that the firm’s advertising disclosed the seller-client’s desire to retain the 0.53-acre parcel, or that the agency relationships were accurately marked in the purchase contract. In a separate transaction, Ferrell was broker-in-charge and supervised dual agents in the sale of a 2.46-acre parcel of unimproved land in a small residential subdivision. Seller gave dual agent a handwritten list of restrictions that the seller intended to run with the land. Ferrell failed to ensure dual agent included the restrictions in the listing agreement or the sales contract.

RALPH MARION HARVEY III (BOYNTON BEACH, FL) – By Consent, the Commission suspended the broker license of Harvey for a period of 1-month, effective July 1, 2024. The Commission found that Harvey listed a property for sale in Rowan County, North Carolina. In March 2023, the property went under contract with Buyer 1. Following a home inspection, Buyer 1 terminated the transaction due to issues identified in the inspection report. Harvey received a copy of the home inspection report but failed to disclose material facts identified in the home inspection report when he relisted the property. Subsequently, the property went under contract again with Buyer 2. Buyer 2 had a home inspection which revealed identical issues to those found during Buyer 1’s inspection. Buyer 2 also terminated the transaction due to the same issues.

MARTY LEON HUSKINS (ROBINSVILLE) – By Consent, the Commission reprimanded Huskins effective July 1, 2024. The Commission found that in 2020, Huskins was the listing agent for the subject property. Huskins measured the property to calculate the square footage but failed to include offsets of the second floor of the subject property which resulted in an inaccurate square footage calculation.

SETH ANDREW LANGDON (KING) – By Consent, the Commission reprimanded Langdon effective July 1, 2024. The Commission found that Langdon entered into a listing agreement with the sellers of the subject property. Following the expiration of the original listing agreement, and prior to the execution of a new listing agreement, Langdon continued to represent the sellers. Langdon did not obtain fully executed copies of the listing agreement and the Mineral, Oil, and Gas disclosure until several weeks after offer and acceptance.

LISTWITHFREEDOM.COM INC (BOYNTON BEACH, FL) – By Consent, the Commission suspended the firm license for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that In February 2023, the firm’s Broker-in-Charge listed a property for sale in Rowan County, North Carolina. In March 2023, the property went under contract with Buyer 1. Following a home inspection, Buyer 1 terminated the transaction due to issues identified in the inspection report. The Broker-in-Charge received a copy of the home inspection report but failed to disclose material facts identified in the home inspection report when he relisted the property. Subsequently, the Subject Property went under contract again with Buyer 2. Buyer 2 had a home inspection which revealed identical issues to those found during Buyer 1’s inspection. Buyer 2 also terminated the transaction due to the same issues.

DANIEL RYAN O’CONNELL (ASHEVILLE) – By Consent, the Commission suspended the broker license of O’Connell for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that O’Connell acted as dual agent for the sale of a 2.46-acre parcel of unimproved land in a small residential subdivision. Seller gave O’Connell a handwritten list of restrictions that the seller intended to run with the land. O’Connell failed to include the restrictions in the listing agreement or the sales contract, and failed to inform the closing attorney of the restrictions which prevented the restrictions from being included in the deed. In a separate transaction, O’Connell was the listing agent for the subject property, which was vacant land in which the seller wished to retain a 0.53-acre parcel. O’Connell failed to specify in the listing agreement the seller’s intent to retain the 0.53-acre parcel of land. Prior to closing, O’Connell failed to reasonably ensure the seller understood the offer submitted included the 0.53-acre parcel. The seller agreed at closing to sell the entire property and was unable to retain the 0.53-acre parcel.

OSCAR OTT (CHARLOTTE) The Commission accepted the voluntary surrender of the real estate license of Ott, effective July 1, 2024. The Commission dismissed without prejudice allegations that Ott violated provisions of the Real Estate License Law and Commission Rules. Ott neither admitted nor denied misconduct.

KELLY LYNN SALTER (JACKSONVILLE) – By Consent, the Commission suspended the broker license of Salter for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Salter was broker-in-charge and failed to complete the Trust Accounting course within 120 days of opening a trust account. Salter provided property management services to 213 properties and maintained 3 trust accounts: rental, security deposit, and vacation rental. Salter failed to report to the Commission that it maintains trust accounts in either the firm application or subsequent renewals. Salter failed to designate “trust” or “escrow” on checks or deposit slips. In two separate months, there was both a shortage and an overage in both the Rental and Security Deposit accounts. The balance on the property ledgers was different from the allotted reserve amounts agreed upon in the property management agreements.

BRYANT MICHAEL TUMBELEKIS (SANFORD) – By Consent, the Commission suspended the broker license of B. Tumbelekis for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that in October 2020, B. Tumbelekis purchased the subject property, which contained an in-ground swimming pool. In June 2022, B. Tumbelekis hired a pool company to inspect the pool for a suspected leak. The inspector located a leak and performed a repair, which was explained as a temporary but long-term solution. In October 2022, B. Tumbelekis advertised the subject property for sale and failed to disclose the swimming pool repair.

ELIZABETH NOELLE TUMBELEKIS (SANFORD) – By Consent, the Commission suspended the broker license of E. Tumbelekis for a period of 12 months, effective July 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that in October 2020, E. Tumbelekis purchased the subject property, which contained an in-ground swimming pool. In June 2022, E. Tumbelekis hired a pool company to inspect the pool for a suspected leak. The inspector located a leak and performed a repair, which was explained as a temporary but long-term solution. In October 2022, E. Tumbelekis advertised the subject property for sale and failed to disclose the swimming pool repair.

JULIA PORTER WILKIE (RALEIGH) – By Consent, the Commission suspended the broker license of Wilkie for a period of 12 months, effective July 1, 2024. The Commission found that from April 2022, through June 2023, Wilkie served as Broker-in-Charge of Tritori Realty Group, Inc. Between 2022 and 2023, several brokers under Wilkie’s supervision failed to adhere to agency requirements. Specifically, upon reviewing transactions handled by supervised brokers, it was found that these brokers routinely failed to furnish and discuss the Working with Real Estate Agents Disclosure form with clients at the time of first substantial contact.

Update: NCREC YouTube Channel has been updated!

Our YouTube channel has a new LOOK!

Video: https://youtu.be/FmNgw5P2AI4

Reminder: Do You Need a Resource? The Commission Has You Covered!

Video: https://youtu.be/95gyEIOdPnA

Did you know the Commission’s website (ncrec.gov) offers a wide variety of resources for brokers?

The resources for brokers include:

- Licensee Login that enables brokers to review their own license records, including contact information, license status, company affiliations, and education history, and update information as needed;

- Broker-in-Charge Login that enables BICs to review the license records of their affiliated brokers, to determine whether they have renewed their licenses and/or completed educational requirements;

- Video Library that provides a variety of brief videos regarding rules and processes; and

- Publications Page that provides access to current and previous editions of the eBulletin, materials from previous years’ Update courses, disclosure forms, Q&A brochures, and the Real Estate Manual.

Also, brokers can use the search bar to find specific information regarding various topics. Do you need more information on material facts? If so, go to the website, click in the search bar and type material facts. Once you have done this, all of the resources, including eBulletin articles that the Commission has published regarding material facts will appear.

For more information, visit the Commission’s website at ncrec.gov.

Changing the Way Brokers View Continuing Education

“Don’t Learn Too Little Too Late”

By Len Elder, JD, DREI, Director of Education & Licensing

Every year, the North Carolina Real Estate Commission creates for brokers two mandatory UPDATE courses. The General Update course is written for brokers and the Broker-in-Charge Update course is written for those who are Brokers-in-Charge or BIC-Eligible. By design, these courses always contain trending brokerage issues and the most pressing disciplinary concerns of Commission members. Further, Commission members choose the topics for the Update courses based on their current handling of recent disciplinary cases, industry changes, and other current issues of concern.

In the 2023-2024 CE season (i.e., July 1, 2023, to June 10, 2024) all of the following important topics were covered in the mandatory Update courses:

- the discovery and disclosure of material facts;

- engaging in unlicensed activity;

- misrepresentations of material facts; and

- broker-in-charge obligations and supervision.

During that same period of time, the Commission published 146 cases in the monthly eBulletin that contained a reference to the subject matter and nature of the violation. Ninety of those cases (61%) involved information that was being taught in the current, mandatory Update courses.

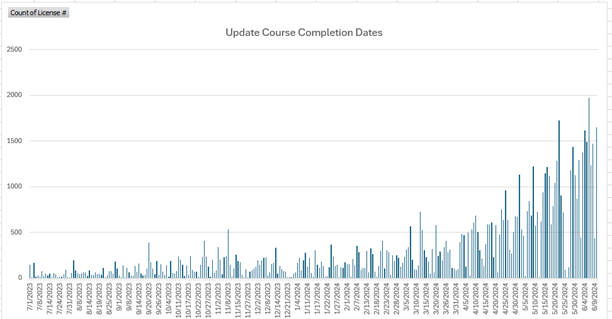

Commission members often ask during probable cause determinations and settlement presentations, “Isn’t this issue covered in the mandatory Update courses?” Education staff assures the Commission members that it is not only mentioned, it is presented in detail. Commonly, it is presented with scenarios and fact patterns, references to statutes and rules, and with best practice tips to avoid a disciplinary action. NCREC’s IT division is able to track when a broker completes their mandatory continuing education, including the Update courses. The data showing exactly when brokers took the mandatory update looks like this:

Although the Update courses first became available on July 1, 2023, as of April 1, 2024, 60,292 brokers still had not completed the mandatory Update course. This number represented 74% of our brokers; many of those who waited ten months to take the mandatory Update course were Brokers-in-Charge.

This means that instead of getting the new education in July, August or September, brokers voluntarily chose to delay being more informed and knowledgeable. Instead, they committed the very violations that the Commission had tried to warn them about in July, and did not get the education they needed until May and June of the following Spring.

It appears that many brokers mistakenly treat continuing education, including the Update course, as another step in the renewal process and something they can delay until spring. This was not the purpose or intent of North Carolina’s creation of a continuing education requirement for brokers.

The purpose of continuing education, especially the Update course, is to make brokers more knowledgeable, more informed and more aware of obligations and duties to protect the public.

The Update courses for 2024-2025 are available for brokers to take NOW. The courses contain education brokers need to avoid a potential disciplinary action over the next 12 months. If only brokers would become more informed, more educated early in the year, we might see a reduction in the number of disciplinary cases. Brokers: Don’t learn too little, too late! You should sign up for the Update course right now and give your clients and consumers the benefit of your increased training all year long.

Navigating Complaints: A How-To Guide

Part One of an in-depth Five-Part series on the Complaint and Disciplinary Process in Regulatory Affairs.

Navigating Complaints: A How-To Guide

The Real Estate Commission investigates complaints against real estate licensees accused of misconduct. If the Commission finds that licensees have violated the Real Estate License Law (N.C.G.S. Chapter 93A) or Commission rules, it can reprimand, suspend or revoke their licenses.

The majority of complaints received by the Commission are submitted by consumers, and sometimes brokers, but they may also be initiated by the Commission or referred from other agencies. Complaints may be submitted on the Commission’s website or by mailing the Complaint Form and any supporting documents to:

North Carolina Real Estate Commission

PO Box 17100

Raleigh NC 27619-7100

All complaints and any supporting documentation will become a public record, and a copy will be given to the real estate licensee complained against. Complaints cannot be withdrawn or deleted. Persons who file complaints must be willing to appear as a witness, be sworn, testify and be cross-examined concerning the allegations made in their complaints.

Complaints should include a narrative of events or plain statement of the allegations against the real estate licensee(s) complained against.

The Real Estate Commission cannot

- Give legal advice,

- Mediate contract disputes,

- Order agreements/contracts to be canceled or enforced,

- Order monies to be paid or refunded, or

- Resolve disputes involving compensation between brokers.

If these types of issues are involved, the complaining witness should consult a private attorney.

When the Commission receives a complaint against a broker, a staff attorney reviews the complaint to determine whether the allegations fall under the jurisdiction of the Real Estate Commission. The staff attorney is not attempting to determine whether the allegations are true or false at this stage. Rather, the attorney must consider: “If all allegations in this complaint are true as written, would the facts as alleged constitute a violation of License law and/or Commission rules?”

If the answer is yes, then a case file is opened and the complaining witness is notified.

If the answer is no, then the Commission staff attorney sends a letter to the complaining witness with information regarding the reason for declining to open a case. The Commission may decline to investigate complaints where no violation of License law and/or Commission rules is alleged, or where it has no jurisdiction. The Commission may also request additional information from the complaining witness before determining whether to open a case.

If a case file is opened and most of the necessary information in an investigation can be gathered by mail, email, or phone, then the case is referred to a Consumer Protection Officer (CPO), who writes to the responding broker and any witnesses to obtain statements and documents.

In addition to investigating complaints against licensees, CPOs investigate complaints against unlicensed persons conducting real estate brokerage activity. As part of their investigations, CPOs

- interview witnesses;

- analyze supporting documentation received during an investigation; and

- testify as witnesses during disciplinary hearings.

They also deliver presentations on License Law and Commission rules to brokers and the public.

Cases which cannot be investigated by a Letter of Inquiry or where the broker fails to respond are assigned to a field investigator who routinely performs face-to-face interviews, audits trust accounts and gathers information and documentation that may be needed to evaluate a complaint.

The Commission does not automatically assume that the allegation(s) in a complaint are true. However, to fulfill its mission to protect the public interest in real estate brokerage transactions, the Commission investigates each complaint to determine whether there is sufficient evidence to suggest that there has been wrongdoing or improper conduct by a licensee.

A copy of the complaint and any documents the Commission received is included with the initial Letter of Inquiry. Pursuant to Rule 58A .0601(e), any broker who receives a Letter of Inquiry shall submit a written response within 14 days of receipt. If additional time is needed to prepare a thorough response, the broker should contact the CPO who wrote the letter of inquiry and request an extension of time to respond, which typically is granted.

When responding to a Letter of Inquiry, a licensee should provide a factual description of the transaction or incident described in the complaint and provide copies of relevant documents to support those statements. The Commission has the authority to expand investigations beyond the allegations described in complaints and may ask for information and/or documentation regarding other aspects of a transaction or matter. Licensees should fully answer the Letter of Inquiry before the deadline or any extension.

Real estate licensees may hire an attorney to assist with responding to a Letter of Inquiry or when meeting with an Auditor/Investigator; however, it is not a requirement. If you are unsure about whether to obtain legal representation, you may want to discuss your situation with an attorney before deciding.

All responses to Letters of Inquiry or interviews are evaluated to determine any need for additional information and/or further investigation. Once the file provides a clear understanding of the facts, or in the case of a field investigation, after the report is completed, a decision is made to either close the file with or without a warning or to forward the case to the members of the Commission to review and determine whether or not a hearing should be ordered in the matter. Only Commission members can order a hearing against a licensee. If the file is closed, the licensee and the complaining witness will receive notification in writing of the decision.

To learn more about the complaint process or to file a complaint, go to the Commission’s website, or contact Regulatory Affairs at RA@ncrec.gov or 919-719-9180.

T. Anthony Lindsey Elected Chair, William “Bill” Aceto, Vice Chair

T. Anthony Lindsey of Charlotte has been elected as Chair and William “Bill” Aceto of Boone as Vice Chair of the North Carolina Real Estate Commission. Their terms will begin on August 1, 2024.

T. Anthony Lindsey was appointed to the Commission in 2019 by Governor Roy Cooper. Lindsey has been active in the real estate industry for nearly 30 years. He is currently Head of Community Development Services with Steel Skin Realty in Charlotte, where he leads their commercial brokerage and real estate development business. He has also worked extensively in support of affordable housing and advocacy of home ownership for low and moderate income households.

Lindsey is a former long serving member of the Board of Directors of the North Carolina REALTORS®, where he served on, and lead, various committees. He also served as the Federal Political Coordinator from 2003 to 2014 for the National Association of REALTORS ®. The North Carolina Association of REALTORS® presented him with the President’s Award in 2019 and the Region 8 Service Award for his commitment, leadership, and service in 2020.

Lindsey is a past member and chair of the City of Charlotte’s Housing Trust Fund Advisory Board, past director and treasurer of the Charlotte Regional REALTOR® Association (now Canopy), and a past director on the Board of Governors of the Real Estate and Building Industry Coalition (REBIC). In 2020, Lindsey received the esteemed, REALTOR® of the Year recognition by the Canopy REALTOR® Association, for his contributions to the profession and the community.

A former contributing writer on affordable housing for PRIDE Magazine, Lindsey speaks at various real estate industry conferences and has served on numerous industry boards and committees.

He is a founding board member, past president, and now treasurer of the North Carolina High School for Accelerated Learning, Inc., a charter school focused on dropout recovery and prevention. A graduate of Johnson C. Smith University, Lindsey started his career with AT&T and Bell Communications Research where he served in several executive positions including corporate director of their Minority & Women-Owned Business Enterprise program and Manager of International Technology Licensing.

William “Bill” Aceto was appointed to the Commission by the General Assembly in 2023. A partner at Blue Ridge Realty & Investments, Aceto specializes in foreclosed/bank-owned properties, investment properties, commercial real estate, developments, large acreage tracts, building lots, residential brokerage and property management, and long term rental housing in the High Country of NC. As a REALTOR® committed to property owners’ rights, Aceto also personally invests in rental properties, land tracts, and residential properties in the Boone area. Aceto and his Blue Ridge Realty & Investments partner, Todd Rice, own and operate Blue Ridge Professional Property Services, LLC, Boone High Country Rentals, and Ashe Rental Agency.

Having held numerous leadership positions for the High Country Association of REALTORS®, Aceto was named the 2020 High Country Association REALTOR® of the Year. Aceto is active in the North Carolina REALTORS®, and was a 2015 Graduate of the NC REALTORS® Leadership Academy and has been the Chair of NCR Legislative, RPAC, & PMD Committees, and a Federal Political Coordinator for NAR® for 10 years. Additionally, he is a public member on the North Carolina Building Commission, a former member of the Town of Boone Board of Adjustment (ETJ Alternate), and past Chairman of the Watauga County Board of Elections. He graduated from Appalachian State University with a degree in Political Science with minors in Business and Criminal Justice and currently serves as the Chair of Appalachian State Board of Visitors. Bill Lives in Boone with his wife Sallie and kids Liam (7) and Maggie (4.5).

How to Avoid an Unintended Inactive Status

Several brokers recently discovered the hard way that a Continuing Education (CE) course they completed before the annual June 10th CE deadline had not been posted to their license record. Unfortunately, some of these discoveries were made too late for renewal purposes, and licenses were placed on inactive status due to clerical errors by an education provider.

Although certified Education Providers (EPs) are required to submit rosters for Commission-approved courses within 7 days after course completion, brokers should not rely totally on the EPs. Sometimes erroneous information, such as a wrong license number, appears on a course roster, or a student is omitted completely.

To avoid unpleasant and unnecessary surprises around renewal time, brokers are strongly encouraged to proactively monitor the posting of accurate information to their license record:

- verify the accuracy of the information printed on the Course Completion Certificate that an EP must provide each student upon the successful completion of a course;

- log into their license record at www.ncrec.gov and personally double check that all completed CE courses are posted…certainly within 10 days after course completion; and

- if there are errors, reach out to the EP with a request that corrections be made.

Please…do not submit any Course Completion Certificate to the Commission unless you are specifically requested to do so by Commission Staff. Educational credit will ONLY be provided based on information submitted directly by a certified EP.

A little vigilance soon after completing a course can save a broker from possibly being inactive in July.

Case Study: But he has a boat!

FACTS: A customer, who was relocating, contacted a broker for help in finding a home in North Carolina. After explaining NC agency and the Working With Real Estate Agents Disclosure, the customer entered into an exclusive buyer agency agreement with the broker.

From the onset of the relationship, the client shared with their buyer agent how excited they were to bring their new pontoon boat down to their new home. After viewing several properties, the client was ready to make an offer on a home in a newer subdivision. The property had a large driveway with plenty of room for their boat. The client also noticed that the neighboring property had a boat as well.

The buyer’s offer was accepted. Ther seller and buyer went under contract, and the transaction concluded successfully. The client moved into the property without any issues. However, a few months later, the client started getting notices with violations and fines from the Homeowner’s Association. Upon speaking with the HOA, the buyer was informed that the subdivision had restrictive covenants that did not allow recreational vehicles to be parked in the driveway of properties.

While the neighbor had a boat parked in their driveway, they were doing so in violation of the covenants and being fined as well.

ISSUE: Did the broker comply with N.C.G.S. §93A-6(a)(1)?

ANALYSIS: No. N.C.G.S. § 93A-6(a)(1) states that the Commission has power to suspend or revoke at any time a license issued under the provisions of this Chapter, or to reprimand or censure any licensee, if following a hearing, the Commission adjudges the licensee to be guilty of making any willful or negligent misrepresentation or any willful or negligent omission of material fact.

A material fact is any fact that could affect a reasonable person’s decision to buy, sell, or lease real property. Therefore, a broker has an affirmative duty to take reasonable steps to discover and disclose material facts to all parties in a transaction. Additionally, brokers are expected to take reasonable steps to discover all pertinent facts that are necessary to serve their clients’ interest. In this case study, the broker neglected to verify information that was of special importance to their client, having a pontoon boat parked at their property.

The Commission also determines whether or not a broker knew of the existence of a material fact by analyzing documents and reviewing written correspondence. The Commission uses the Reasonableness Standard to evaluate a broker’s duty to discover and disclose material facts. This standard dictates that a broker has a duty to discover and disclose any particular material fact if a reasonably knowledgeable and prudent broker would have discovered the fact during the course of the transaction and while acquiring information about the property.

In this scenario, the broker neglected to discuss the possibility of restrictive covenants with their client. While the broker would not necessarily be expected to interpret the covenants, they would be expected to provide the covenants and caution the buyer to take notice of recreational vehicles and/or boats. The broker did not act like a reasonably prudent broker because theyfailed to properly discover and disclose a material fact of special importance to their client. Every broker must exercise reasonable care and diligence in timely discovering and disclosing material facts to all interested parties in a transaction in adherence to N.C.G.S. § 93A-6(a)(1).

As a result of this omission and the broker’s failure to adhere to N.C.G.S. § 93A-6(a)(1), the broker may be subject to disciplinary action by the Commission.

Resources:

N.C.G.S. § 93A-6(a)(1), 93A-6(a)(8), and 93A-6(a)(10)

License Law and Commission Rules: Rule 58A .0114(c)

Articles: 2022-2023 General Update Course

2018-2019 General Update Course

Tech Corner: Subscribe to the Commission’s YouTube Channel

Did you know that the North Carolina Real Estate Commission has a YouTube channel? Have you subscribed to the channel? If not, watch this video to learn more.

Video: https://youtu.be/p-Y3nQzuGKM

Staff Appearances

Tiffany Ross, Consumer Resource Officer, and Kizzy Crawford Heath, Assistant Director of Education and Licensing, spoke at Berkshire Hathaway HomeServices York Simpson Underwood Meeting on July 16.

Len Elder, Director of Education and Licensing, spoke at Durham Regional Association of REALTORS® on July 24.

Bruce Rinne, Information Officer, spoke at Catawba Valley Association of REALTORS®, on July 29.