Bulletin Search

NCREC has a New Learning Management System

NCREC is pleased to announce a new partnership with DigitalChalk, and the launch of a modernized training portal designed to enhance course administration and deliver a more intuitive, efficient, and dependable learning experience for all Commission-offered courses such as the 12-Hour BIC Course and the Trust Account Course.

How to Access the Training Portal:

1. Visit learn.ncrec.gov.

2. On your first visit, create an account using your email address as your username.

3. Browse the course catalog and purchase the courses you want.

4. After purchase, your course will appear under “Courses” in the left-hand menu. 5. For questions or technical assistance, email EDUC@ncrec.gov.

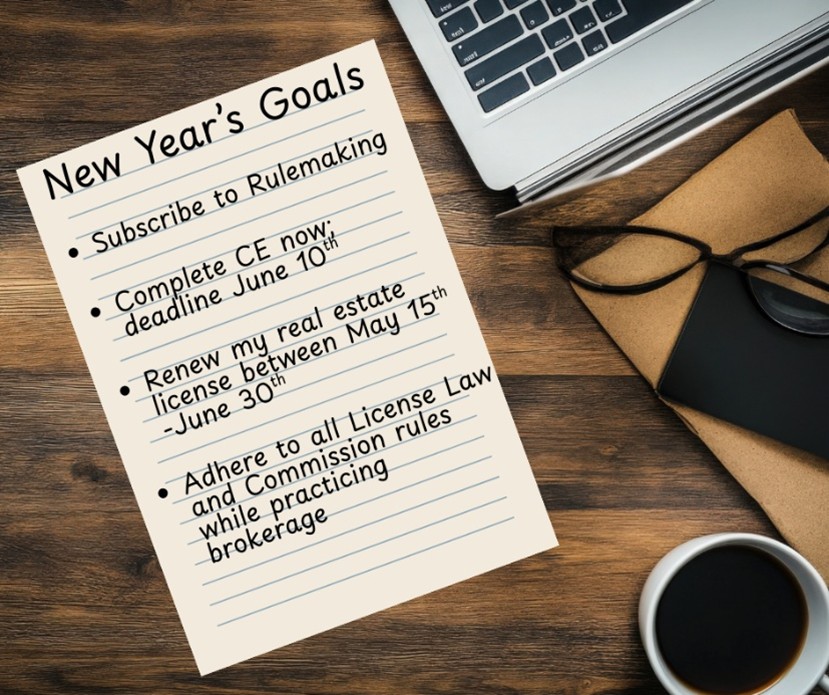

Reminder: Complete Your CE Today!!

Script: Don’t wait until the last minute to complete your 8-hour continuing education requirement! Finishing your courses early helps you avoid the stress and scheduling conflicts that can come with waiting until the deadline. Completing CE before June 10th and renewing your license by June 30th is essential to keeping your license active—missing these dates could result in an inactive or expired license, which means you cannot provide brokerage services starting July 1st. Getting your CE done early also ensures you stay current on License Law and Commission rule changes. If you haven’t registered for your continuing education classes yet, now, at the beginning of this new year, is a great time to do so!

New Year, New Goals!

Did you create a resolution for 2026? Do you need resolution ideas?

One resolution to embrace is a renewed commitment to increasing your brokerage knowledge and compliance. Staying current on NCREC rules and legal updates, while completing continuing education early and with intention, strengthens competence and confidence. Ongoing learning in areas such as material facts, agency, risk management, and emerging industry issues, helps brokers make informed decisions, reduce liability, and consistently meet their requirements under License Law and Commission rules.

Another important resolution is to lead every transaction with competence, fairness, and integrity. Prioritizing fair housing compliance, clear communication, and unbiased treatment of all consumers reinforces public trust and confidence in real estate brokerage.

Happy New Year

As 2026 begins, the North Carolina Real Estate Commission warmly thanks all real estate brokers for your dedication, professionalism, and contributions to the profession. Your commitment helps raise the standards of real estate practice across the state.

This year, we wish you continued success, growth, and new opportunities in your real estate career. The Commission remains committed to supporting you with educational resources, guidance on regulatory compliance, and updates on License Law and Commission Rules. Staying informed and proactive ensures you can navigate the dynamic real estate market with confidence.

If you have questions regarding License Law, Commission Rules, or permissible brokerage activities, Regulatory Affairs is available to assist you at regulatoryaffairs@ncrec.gov.

May 2026 bring you fulfillment, achievement, and continued success in all your real estate endeavors!

Tech Corner

Are Your Ads Compliant?

Every advertisement you publish must follow NCREC License Law and Rules—specifically Rule A.0105, which governs how brokers advertise real estate and brokerage services.

Here’s what you need to know to stay compliant:

You Must Have Your Broker-in-Charge’s Consent Before Advertising

Rule A.0105 states:

Before advertising any brokerage service or any real estate for another person, you must obtain your Broker-in-Charge’s consent.

This applies to:

- Listing announcements

- “Coming soon” posts

- Open house flyers

- Market updates that mention your services

- Any social media content promoting your role as a broker

Every Ad Must Clearly Display Your Firm’s Name

Another key part of Rule A.0105:

Your advertisement must include the name of the firm or sole proprietorship you’re affiliated with.

This means:

- No posting ads that only show your personal branding

- No using just your name or logo without your firm’s name

- No “minimalist ads” that omit firm identification for aesthetic reasons

On social media, the firm name must be included in the actual ad content, not just in your bio or profile.

Never Advertise or Place a Sign Without Written Owner Permission

Under Rule A.0105, a broker cannot:

- Place a “For Sale” or “For Rent” sign

- Post a listing

- Promote a property online

…unless you have the owner’s written consent.

A verbal agreement is not enough—written permission protects everyone involved and ensures you are legally authorized to advertise the property.

Avoid Blind Ads—Your Ads Must Show You Are a Broker

A “blind ad” is any advertisement that suggests the offer is being made by the broker’s principal only.

Every such advertisement shall indicate that it is the advertisement of a broker or firm and shall not be confined to publication of only contact information, such as a post office box number, telephone number, street address, internet web address, or e-mail address.

Special Requirements for Limited Nonresident Commercial Brokers

If you are licensed as a Limited Nonresident Commercial Broker, Rule A.0105 requires that you also comply with Rule A.1809, which states: In all advertising involving a nonresident commercial licensee’s conduct as a North Carolina real estate broker and in any representation of such person’s licensure in North Carolina, the advertising or representation shall conspicuously identify the nonresident commercial licensee as a “Limited Nonresident Commercial Real Estate Broker.”

Why This Matters

Non-compliant advertising, even unintentional mistakes, can result in disciplinary action from the Commission.

But the good news? Staying compliant is simple when you follow these core guidelines:

- Get BIC approval

- Include your firm’s name

- Obtain written owner permission

- Avoid blind ads

- Follow special rules if you’re a nonresident commercial broker

By aligning every advertisement with Rule A.0105, you protect your license and your reputation.

Disciplinary Actions

JAMES BAKER, JR. (WILSON)- By Consent, the Commission reprimanded Baker effective October 10, 2025. The Commission found that Baker acted as the listing agent on a failed transaction. During the course of the transaction, the buyer placed a stop payment order on their earnest money check and Baker’s seller, who lived out of state, wanted to sue the buyer for the earnest money. On or about December 2024, Baker, who is not an attorney, filed a civil complaint in Small Claims court on behalf of his client for the disputed funds.

CURTIS BLAKE, JR. (FAYETTEVILLE)– By Consent, the Commission suspended the broker license of Blake for a period of 6 months, effective November 24, 2025. The Commission found that Blake was an instructor in a pre-licensing course during which, Blake scheduled viewings in vacant and/or staged houses so that he and a student could meet for purposes unrelated to brokerage activities.

ANDREA GRUNDY (ERNUL)- The Commission accepted the voluntary surrender of the real estate license of Grundy, effective November 19, 2025, with no right to reapply for 10 years. The Commission dismissed without prejudice allegations that Grundy violated provisions of the Real Estate License Law and Commission Rules. Grundy neither admitted nor denied misconduct.

ASHLEY HART (TUCSON)- By Consent, the Commission suspended the broker license of Hart for a period of 6 months, effective November 1, 2025. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Hart was denied a passing score by the provider of a post-licensing course for alleged cheating on a remote proctor-free exam. Video of the exam shows Hart appearing to type on a separate off-camera device although Hart denied using another device during the exam.

TAYLOR KISER (PINNACLE)- By Consent, the Commission reprimanded Kiser, effective November 19, 2025. The Commission found that Kiser was convicted of Driving While Impaired – Level 4. This was Kiser’s third conviction for driving under the influence of alcohol. Kiser’s driving privilege is currently suspended. Kiser shall comply with any and all restrictions placed on her driving privilege and shall not transport customers or clients while her vehicle is equipped with an ignition interlock device.

KRISTEN NEAL (DURHAM)- By Consent, the Commission reprimanded Neal, effective November 1, 2025. The Commission found that Neal was denied a passing score by the provider of a post-licensing course for alleged cheating on a remote un-proctored exam. Neal admitted to using a cellphone during the exam to text her spouse but denied using the phone to cheat. Neal acknowledged that the exam instructions barred having a cellphone within reach during the exam. Neal subsequently retook the course and exam and is now a full broker.

PAUL PORTERFIELD (GRIFTON)- The Commission accepted the permanent voluntary surrender of the real estate license of Porterfield, effective November 19, 2025. The Commission dismissed without prejudice allegations that Porterfield violated provisions of the Real Estate License Law and Commission Rules. Porterfield neither admitted nor denied misconduct.

PETER RUSSELL (CHARLOTTE)- The Commission accepted the voluntary surrender of the real estate license of Russell, effective November 19, 2025, with no right to reapply for 2 years. The Commission dismissed without prejudice allegations that Russell violated provisions of the Real Estate License Law and Commission Rules. Russell neither admitted nor denied misconduct.

CESAR SANCHEZ (RALEIGH)- By Consent, the Commission suspended the broker license of Sanchez for a period of 36 months, effective May 1, 2025. The Commission then stayed the suspension following a 6.5-month active period upon certain conditions. The Commission found that Sanchez acted as a listing agent and provided a lockbox code to a potential buyer without the seller’s consent. Sanchez requested payment of a due diligence fee after falsely communicating that an offer was accepted and under contract before a written offer was submitted. Sanchez misrepresented that the property was stick built even after being provided with the manufacture label and failed to provide transaction documents to his broker-in-charge in a timely manner. Sanchez failed to fully disclose material facts learned from the first buyer’s inspection to a subsequent buyer.

Proposed Rule Changes: Public Comment Period Now Open

The North Carolina Real Estate Commission is seeking public input on proposed amendments to Rules 21 NCAC 58A .0112, .0302, .0503, and .1803; 58G .0103; 58H .0101 and .0210; as well as the adoption of a new rule, 21 NCAC 58A .0513.

The public comment period will run from November 17, 2025, through January 16, 2026. The Commission will also hold a public hearing on December 17, 2025, at 8:30 a.m. at its office located at 1313 Navaho Drive, Raleigh, North Carolina.

Real estate brokers and members of the public are invited to review the proposed rule changes and provide feedback. Written comments may be submitted by email or mailed to the address below. Comments may also be convened orally, directly to the Commission, by attending the scheduled public hearing.

Melissa A. Vuotto

Rulemaking Coordinator

North Carolina Real Estate Commission

P.O. Box 17100

Raleigh, NC 27619

Commission Presentations

November 2025 Presentations

Kizzy Crawford Heath, Assistant Director of Education and Licensing, spoke at Triangle Board of Realists on November 11th.

Christy Evans, Consumer Protection Officer, spoke at Raleigh Realty Inc. on November 12th.

Bruce Rinne, Information Officer, and Michael Davis, Auditor, spoke at Bold Real Estate on November 12th.

Lyndi James, Auditor, spoke at Keller Williams Innovate on November 18th.

December 2025 Presentations

*These presentations are subject to change due to the availability of Commission members and/or staff.*

Bruce Rinne, Information Officer, will speak at Urban Durham Realty on December 9th.

Miriam Baer, Executive Director, will speak at Jacksonville Board of REALTORS® on December 10th.

Fair Housing Symposiums

The Commission sponsored three Fair Housing Symposiums in 2025 in Durham, Charlotte, and Wilmington. While it’s common knowledge that the Fair Housing Act prohibits discrimination in housing and housing-related transactions based on race, color, sex , national origin, religion, disability, or familial status, these Symposiums dug deeper into issues of income discrimination and the disparate impact that certain policies can have on protected classes of people.

For example, under the FHA, it is illegal to refuse to rent to someone who intends to pay their rent with lawful sources of income like housing assistance vouchers, subsidies, or other forms of public assistance. This is an example of income discrimination, and all brokers should be aware of similar behavior.

Some brokers may have policies in place that on their face do not appear discriminatory, but in practice and effect are. An example of this is a landlord who requires all tenants to be employed full-time. Her reason is to ensure that every tenant can pay their rent, but this policy essentially bars tenancy to certain disabled people, seniors, and/or veterans who have enough income, but are not employed full-time.

North Carolina brokers should educate themselves to ensure they follow the fair housing laws to allow everyone access to housing. For more information on fair housing and your responsibilities as a broker, click here: https://www.ncrec.gov/FHResources/AdditionalResources