Bulletin Search

Reminder: Your Email Address is Important!

Did you know that the Commission uses electronic communication to correspond with licensees? Is the correct email address listed in your license record?

Pursuant to Rule 58A .0103(a),

Upon initial licensure, every broker shall notify the Commission of the broker’s current personal name…and email address.

Subsection (b) of Rule 58A .0103 specifies:

Every broker shall notify the Commission in writing of each change of personal name…and email address within 10 days of said change.

Brokers must ensure that the Commission always has the correct email address in their license record. A current email address is imperative because the Commission sends the following correspondence electronically:

- renewal reminders,

- notification of license record changes and/or status, and

- Letters of Inquiry concerning complaints.

Brokers may log-in to their license record at any time to update their information to adhere to Rule 58A .0103.

Case Study: Agency

FACTS: A broker had been managing a vacation rental property in the mountains for a client for several months.

The client decided to sell the vacation property and asked the broker to assist. The broker traditionally works only in property management but had prior experience in sales. The broker felt that since they knew the property intimately, they would represent the seller’s property better than another broker.

The broker discussed agency, terms, pricing, marketing, and other aspects of the property with the seller-client. The seller-client signed the Working with Real Estate Agents Disclosure (WWREA) form and completed the Residential Property and Owner’s Association Disclosure (RPOADS). The broker then advertised the property on their website as being for sale.

After receiving a couple of offers on the property, the seller wished to accept a lower offer because it was a cash offer with a quick closing date. The seller asked their broker to provide an estimated net to seller with the proposed terms. In this estimate, the broker charged a 5.5% commission. The seller questioned this charge as they understood the commission would be 4.5% because of the property management relationship with the broker.

The broker was unable to produce a signed listing agreement.

ISSUE: Did the broker comply with 21 NCAC 58A .0104(a)?

ANALYSIS: No. Commission Rule 58A .0104(a) requires that every agreement for broker services between a broker and an owner of the subject property be in writing and signed by the parties at the time of its formation. In this scenario, the broker listed the property for sale on their website without a written and signed agreement.

The North Carolina Real Estate Commission has long made clear the implications regarding listings. No broker may undertake to provide any brokerage services to a seller without a written listing agreement. A broker who engages in advertising, holding open houses, or acting on behalf of a seller in the absence of a written express agreement with the owner of the property operates in violation of Rule 58A .0104.

In addition, to violating Commission Rule 58A .0104(a), the broker potentially violated N.C.G.S. § 93A-6(a)(8):

“Being unworthy or incompetent to act as a real estate broker in a manner as to endanger the interest of the public.”

The Commission determines whether or not a broker acted competently by analyzing documents and reviewing written correspondence. The Commission uses the Reasonableness Standard to evaluate a broker’s expected competency. A broker must exercise that degree of skill, care, and diligence that a reasonably prudent real estate broker would exercise under similar circumstances.

In this scenario, the broker acted outside of their normal expertise and failed to adhere to Commission Rule 58. 0104(a) by not having a signed agreement before listing the property. The broker did not act like a reasonably prudent broker because they failed to provide the necessary skill, care, and diligence their client required.

N.C.G.S. § 93A-6(a)(15) states that the Commission has power to suspend or revoke at any time a license issued under the provisions of this Chapter, or to reprimand or censure any licensee, if following a hearing, the Commission adjudges the licensee to be guilty of violating any rule adopted by the Commission.

As a result of the broker advertising the property without a listing agreement pursuant to Rule 58A .0104 and the broker’s failure to adhere to N.C.G.S. § 93A-6(a)(15), the broker may be subject to disciplinary action by the Commission.

RESOURCES:

N.C.G.S. § 93A-6(a)(15), 93A-6(a)(8), and 93A-6(a)(10)

License Law and Commission Rules: Rule 58A .0104

Articles: Getting Agency Representation Right…

Staff Appearances

Minerva Mims, Diversity, Equity, and Inclusion Officer, spoke at the NC REALTORS® on April 1.

Miriam Baer, Executive Director, spoke at the Albemarle Area Association of REALTORS® AAAR General Membership meeting on April 9.

Brian Heath, Consumer Protection Officer, spoke at Brunswick County Association of REALTORS® on April 11.

Minerva Mims, Diversity, Equity, and Inclusion Officer, spoke at the City of Gastonia on April 11.

Charlie Moody, Deputy Legal Counsel, spoke at Premier Sotheby’s International Realty on April 11.

Steve Fussell, Chief Consumer Protection Officer, spoke at United Real Estate Queen City on April 24.

Bruce Rinne, Information Officer, spoke at Meredith Christy Real Estate on April 24.

Tech Corner: How to Make a PowerPoint using AI

Video Link: https://share.synthesia.io/5f135c3a-2cc3-44d3-92d6-6e2c0314ad71

Disciplinary Actions

JAMES RAY HALL JR (FAYETTEVILLE) – By Consent, the Commission suspended the broker license of Hall for a period of 12 months, effective February 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Hall, acting as a co-listing agent, paid for renovations and additions to a listed property and advertised it as connected to city sewer. Following closing, the buyer learned that the property was not connected to city sewer. Hall failed to verify that a permit was obtained for the renovations and additions to the property and failed to disclose the lack of permits to the buyer.

WILLIAM M. LITTLE (FAYETTEVILLE) – By Consent, the Commission suspended the broker license of Little for a period of 12 months, effective February 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Little, acting as broker-in-charge, failed to maintain required property management records, had an overage in the security deposit account, and failed to timely provide documentation upon request by the Commission.

LITTLE & YOUNG, INC. (FAYETTEVILLE) – By Consent, the Commission suspended the firm license for a period of 12 months, effective February 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that the firm failed to maintain proper property management records, had an overage in the security deposit account, and failed to timely provide documentation regarding HOA management upon request by the Commission.

BRYCE HOWARD SMITH (CHARLOTTE) – By Consent, the Commission suspended the broker license of Smith for a period of 2 months, effective March 1, 2024. The Commission found that Smith, acting as Qualifying Broker of Charlotte Homes & Rentals, LLC, allowed the continuation of brokerage services from July 1, 2022 to May 2, 2023, without an active and designated Broker-in-Charge.

CHARLOTTE HOMES & RENTALS LLC (CHARLOTTE) – By Consent, the Commission suspended the firm license for a period of 5 years, effective March 1, 2024. The Commission found that the firm continued to operate and conduct brokerage services throughout a 10-month period from July 1, 2022 to May 2, 2023, without an active broker-in-charge.

STEVEN ROBERT SPENCER (WAKE FOREST) – By Consent, the Commission suspended the broker license of Spencer for a period of 24 months, effective March 1, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Spencer, acting as broker-in-charge, failed to respond to Letters of Inquiry in a timely manner and failed to adequately ensure proper advertising. Spencer oversaw a transaction in which the property was advertised as containing 3 bedrooms despite the septic permit only allowing for 2 bedrooms.

MOISES C. MIRANDA (GASTONIA) – By consent, the Commission suspended the broker license of Miranda for a period of 12 months, effective March 15, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Miranda listed a home that went under contract and the home inspection uncovered various issues. Following the termination of that transaction, Miranda relisted the property but failed to disclose the material facts learned during the first transaction.

MARGARET A. SOPHIE (CARY) – By Consent, the Commission reprimanded Sophie, effective March 20, 2024. The Commission found that Sophie failed to inquire further about certain disclosures by her seller-client on the RPOADS form, leading to her failure to discover and disclose material facts about the road maintenance of the subject property. Consequently, the buyer discovered after closing that they have responsibility for repairs, a fact that was well-known by all owners on the road, including the seller.

TRAVIS REYNOLDS HUDSON (RALEIGH) – By Consent, the Commission reprimanded Hudson, effective March 20, 2024. The Commission found that Hudson, acting as buyer’s agent, failed to advise his buyer-client on the relevance of certain responses on an RPOADS private street disclosure question and otherwise failed to discover and disclose the buyer’s responsibility for road maintenance of the subject property prior to closing.

AUTUMNE VAUGHAN BENNETT (CARY) – By Consent, the Commission reprimanded Bennett, effective March 20, 2024. The Commission found that Bennett, acting as broker-in-charge for a listing agent, failed to adequately supervise her broker-affiliate regarding material fact disclosure of road maintenance responsibilities of the subject property. Consequently, the listing agent failed to discover and disclose material information related to a seller-client’s responses on the RPOADS form and the buyer discovered after closing that they are responsible for repairs, a fact that was well-known by all owners on the road, including the seller.

CLIO MADELEINE CARROLL (ABERDEEN) – By Consent, the Commission suspended the broker license of Carroll for a period of 6 months, effective March 20, 2024. The Commission then stayed the suspension in its entirety upon certain conditions. The Commission found that Carroll was the listing agent for a transaction in which a buyer’s agent submitted an offer on behalf of their buyer-clients that included an escalation clause. Carroll communicated to the buyer’s agent that another offer had been received and delivered a copy of the other offer to the buyer’s agent without first receiving permission from the other buyer. Carroll acknowledged her failure to obtain permission before disclosing the other offer.

MARK EZIO CARLTON (WILMINGTON) – By Consent, the Commission suspended the broker license of Carlton for a period of 12 months, effective March 15, 2024. The Commission then stayed the suspension in its entirety and placed Carlton on probation through March 15, 2025, upon certain conditions. The Commission found that Carlton failed to notice and disclose to his buyer client that there was a discrepancy in which a septic system was noted on the RPOADS form but the property was advertised as having city sewer in the MLS. The discrepancy was later discovered by a broker affiliated with Carlton’s firm who advised the buyer to have a septic inspection completed prior to completion of the closing. Carlton paid for the inspection, after which the buyer closed the transaction.

TRITORI REALTY GROUP INC. (RALEIGH) – By Consent, the Tritori Realty Group voluntarily surrendered its firm license with no right to reapply for a period of two (2) years, effective March 13, 2024. Tritori Realty Group Inc. neither admitted nor denied misconduct.

SCOTT O. MCDONALD (WEAVERVILLE) – By Consent, McDonald voluntarily surrendered his broker license with no right to reapply for a period of two (2) years, effective March 13, 2024. McDonald neither admitted nor denied misconduct.

Rolling out the Revised RPOADS!

At its March 2024 meeting, the Commission approved the revised RPOADs form for use beginning July 1, 2024. If you haven’t seen it yet, click here to take a look. The format is different, but many of the questions are the same. In addition, more detailed questions have been added addressing flooding and related issues. Other questions were revised, deleted or added. The form is longer, largely due to the many requests the Commission received to increase the font size.

The first page contains updated instructions for owners, buyers, and broker. Familiarize yourself with the revised instructions and form. Brokers are required to inform their clients/customers about their rights and duties related to the Disclosure, so it’s important that you know and understand them yourself.

The law (N.C.G.S. 47E) requires residential property owners to complete the Disclosure Statement and provide it to the buyer prior to any offer to purchase. If the owner fails to do so, a buyer may be able to cancel any contract. There are limited exemptions for completing the form, such as new home construction that has never been occupied.

Owners are required to answer every question by selecting Yes (Y), No (N), No Representation (NR), or Not Applicable (NA). Owners may choose to make no representation for all or some of the questions on the form. Some characteristics or features simply may not apply to a particular property; these (and only these) now have a “NA” option. If an owner selects NA, it means the property does not contain a particular item or feature.

It is important for licensees to remember that the disclosures made in the Disclosure Statement are those of the owner(s), not the listing broker. A broker’s duty to disclose is separate from that of the owner. If you represent the owners, and they choose to make no representations, be sure you advise them that you are still obligated to disclose any material facts about the property to potential buyers.

If an owner selects Y or N, the owner is only required to disclose information about which they have actual knowledge. If they answer Y to any question, they should provide an explanation of the issue, or they can attach a report from an attorney, engineer, contractor, pest control operator, or other expert or public agency describing it.

If an owner selects N, the owner is indicating they have no actual knowledge of the matter, including any problem. If the owner selects N and the owner knows there is a problem or that the owner’s answer is not correct, the owner may be liable for making an intentional misstatement. A broker representing an owner should be sure their client understands this.

Owners are not required to disclose any of the material facts that have a NR option, even if they have knowledge of them. However, licensees should be aware that an owner’s failure to disclose hidden defects may result in civil liability for the owner. If an owner selects NR, it could mean that the owner (1) has knowledge of an issue and chooses not to disclose it; or (2) simply does not know. If you are representing a buyer, be sure you explain this to the buyer when you review the Disclosure with them. Simply sending them the Disclosure is not sufficient. Instead, review it with them, and advise them to get their own inspections to determine any defects that aren’t revealed in the Disclosure. The Disclosure is not a warranty of any kind, and no Disclosure is a substitute for a thorough home inspection. Remember, many defects are hidden, and the owner may not have discovered them yet. Also, let your buyer clients know that the Disclosure only applies to dwellings (structures intended for human habitation) so detached sheds, garages, etc. need to be inspected as well.

All brokers, owners and buyers should keep signed copies of the Disclosure for their records. If the listing broker or owner discovers something about the property after the Disclosure has been completed or given to the buyer, the Disclosure must be updated and any buyer, or prospective buyer, should be immediately informed.

Finally, remember that brokers cannot complete the form for the owner, but they must advise the owner to answer all questions on the form, even if it is with NR. A broker selling property they own must complete the form unless exempt, and they can still select NR. However, selecting NR does not relieve them from their duty as a broker to disclose material facts they know or should reasonably know about the property. Therefore, if you are selling your own property, as a broker, you MUST make disclosures, either using the form or separately.

If you list a property prior to July 1, 2024, you do not need to have your owners create a new disclosure using the revised form. You can use the new form if you want to try it out; however, the current one is just fine. If you have to update the form, beginning July 1, you must use the revised one. For any listings taken on or after July 1, use the revised form only.

Remember, communication with your clients about everything is always key. If you represent the owners, explain the form to them, make sure it is completed and provided, and updated as necessary. Don’t take the owners’ word for things without verifying before you advertise features. Make your own reasonable investigation and required disclosures. Disclosures are best made in writing so you can demonstrate you made them if there is ever any question. If you represent a buyer, explain the Disclosure, go through it with them, be sure every question is answered, and explain the importance of getting their own thorough inspections. Following up with an email documenting your discussions with your clients will help if there is ever any question. Look for issues when you visit the property, and follow up with your buyers’ expressed specific needs to be sure the property is suitable for them. These additional steps may take you a little time on the front end, but can save you a lot of time down the road.

Public Vs. Agent – Only Remarks: What’s the Deal?

As a listing agent, you spend lots of time entering information into the Multiple Listing Service (MLS). This could actually take several hours and it’s important that you double check the information to ensure accuracy. After all, you don’t want to misrepresent the listing. Once you have finished entering all the data, the MLS contains two sections for adding text about the property – the public section and the agent-only section.

Now it’s time for the creative part… the public remarks section. If creativity comes easy to you, the public remarks section will flow naturally. Some brokers like to identify the special features or describe the property in a way that allows the buyers to visualize themselves living there. Brokers who struggle with creativity may also simply state the basic facts about the property; both of these approaches are acceptable, so long as the information provided is accurate.

Have you ever wondered exactly what type of information should be entered into the agent-only section of the MLS? Let’s break it down. The information entered is private information provided by the listing agent to potential buyer agents. This information may include facts about the showing instructions such as, “Sellers work night shifts so no showings in the AM” or “Please allow time for sellers to remove two unfriendly dogs” or even, “Sellers would prefer a six week closing.” The remarks in this particular section are disclosed to other agents, not to the public.

What happens when a material fact is discovered about a property that needs to be disclosed and the seller is unwilling to disclose it in the Residential Property and Owners’ Association Disclosure Statement (RPOADS)? Listing agents are still required to disclose material facts they know about the property, even if the seller indicates “No Representation” on the disclosure form. Some listing agents make these disclosures in the public remarks section of the MLS. After all, the point of discovering and disclosing material facts is to put the public (not just other brokers) on notice in order for them to make an informed decision about whether or not they want to submit an offer.

For example, let’s say your listing has gone under contract and the buyer’s inspector has discovered a deteriorated joist in the crawl space. The buyer terminates and the property is back on active status. Obviously, the RPOADS is the most appropriate place to disclose material facts. However, agents occasionally have sellers who are unwilling to update the disclosure. If this is the case, the listing agent may choose to make their required disclosure in the public section of the MLS. Brokers showing listings should always review this section and provide any disclosures to potential buyers. Additionally, a prudent listing agent will notify a potential buyer in writing and prior to offer submission by sending an email of disclosure to the buyer agent or, directly to the buyer if they are not represented. This is especially important when the buyer agent is not a member of the MLS.

Remember, the agent-only section is for providing important information to other brokers and not for disclosing material facts.

The North Carolina Real Estate Educators Conference

The North Carolina Real Estate Commission was pleased to host its 2024 Spring Educators Conference on Tuesday, March 19, 2024, at the McKimmon Center in Raleigh. The theme of the conference was NCREC Education Superhero Comicon.

The registration for the conference was limited to 300 participants. Len Elder, Director of Education and Licensing and Kizzy Crawford Heath, Assistant Director of Education and Licensing, opened the conference. Jeff Malarney, Commission Chair, welcomed all of the attendees.

The day-long event featured the following presentations by Commission Staff members.

- Inside the Justice League by Miriam Baer, Executive Director

- Headline from the Daily Planet by Len Elder, Director of Education and Licensing

- Preserving Your Superhero Identity by Andrew Cox, Education Approval & Renewal Officer

- The Opportunities We Face by Cox, Beth McGonigle, Education Content Officer, Cathy Worsley, Course Review Officer, Deb Carpenter, Education & Examination Officer, Diana Jasany, Communications Officer, Kizzy Crawford Heath, Assistant Director of Education & Licensing, Tiffany Ross, Consumer Protection Officer, and Elder.

- Using Animatrons to Increase Your Superpowers by Jasany, Ross, and Worsley

- The S.H.I.E.L.D. Report by Janet Thoren, Director of Regulatory Affairs and Kristen Fetter, Assistant Director of Regulatory Affairs

- Superhero Training Academy by Carpenter

- Deploying Countermeasures by Cox, Carpenter, Crawford Heath, Elder, Jasany, McGonigle, Ross, and Worsley

- Force Fields and Magic Scepters by Carpenter and McGonigle

- Superhero Recognition by Commission Chair Malarney

- Truth, Justice, and the American Way by Elder

The conference concluded with the presentation of the 2024 Larry A. Outlaw Excellence in Education Award to Bill Gallagher by Commission Chair Malarney. The Commission established the Larry A. Outlaw Excellence in Education Award in 2016 to honor the Commission’s late former Director of Education and Licensing Division. This year’s recipient of the Larry A. Outlaw Award, Bill Gallagher, demonstrated ongoing excellence in outstanding contributions to real estate education in North Carolina. The Commission thanks North Carolina’s real estate education community for its continued interest and support, and congratulates Bill Gallagher on his award.

Simplified Continuing Education to Increase Professional Competence

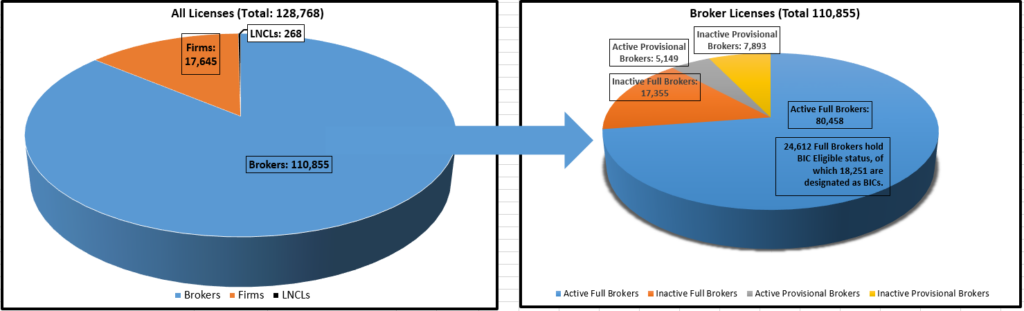

Pursuant to Rule 58A. 1702, North Carolina brokers must complete eight credit hours of real estate continuing education each license year. The eight hours consist of:

- four credit hours of elective courses; and

- four credit hours of either the General Update Course or the Broker-in-Charge Update Course.

All brokers without BIC-Eligible status and provisional brokers must attend the General Update Course and all Brokers-in Charge and BIC Eligible Brokers must attend the Broker-in-Charge Update Course. A broker is required to complete eight credit hours of continuing education by June 10th at 11:59 PM EST. This requirement begins upon the second renewal following initial licensure and upon each subsequent annual renewal.

In the past, Rule 58A .1708 permitted brokers to request equivalent credit for a course that was not approved by the North Carolina Real Estate Commission by submitting a $50 fee, course outline and completion certificate. On July 1, 2023, the availability of equivalent credit was removed for all brokers, except an instructor who either authored or taught a course. Therefore, there is no equivalent credit offered for a course that is not currently approved by NCREC. A broker who previously submitted courses for equivalent continuing education credit should take the required Update course and an approved North Carolina elective prior to the June 10th deadline.

Rule 58A .1708 was changed to ensure that all North Carolina brokers are required to take North Carolina approved courses. The change also eliminates the need for brokers to pay additional fees, especially when courses were not approved for equivalent credit.

Rule 58A .1711 previously exempted brokers who were licensed in another state from the continuing education requirements in North Carolina. On July 1, 2023, the Commission repealed that rule. All brokers licensed in North Carolina must meet the same eight hour continuing education requirement. The prevalence of online courses means that this is no longer an unreasonable burden for licensees living outside North Carolina.

These rule changes were intended to make things simpler for brokers and to assure that all brokers in North Carolina obtain the same education regarding North Carolina rules, statutes and information to ensure the competence of brokers practicing in the state. If you have questions about the status of your continuing education, you can login and check your continuing education record on the Commission’s website.